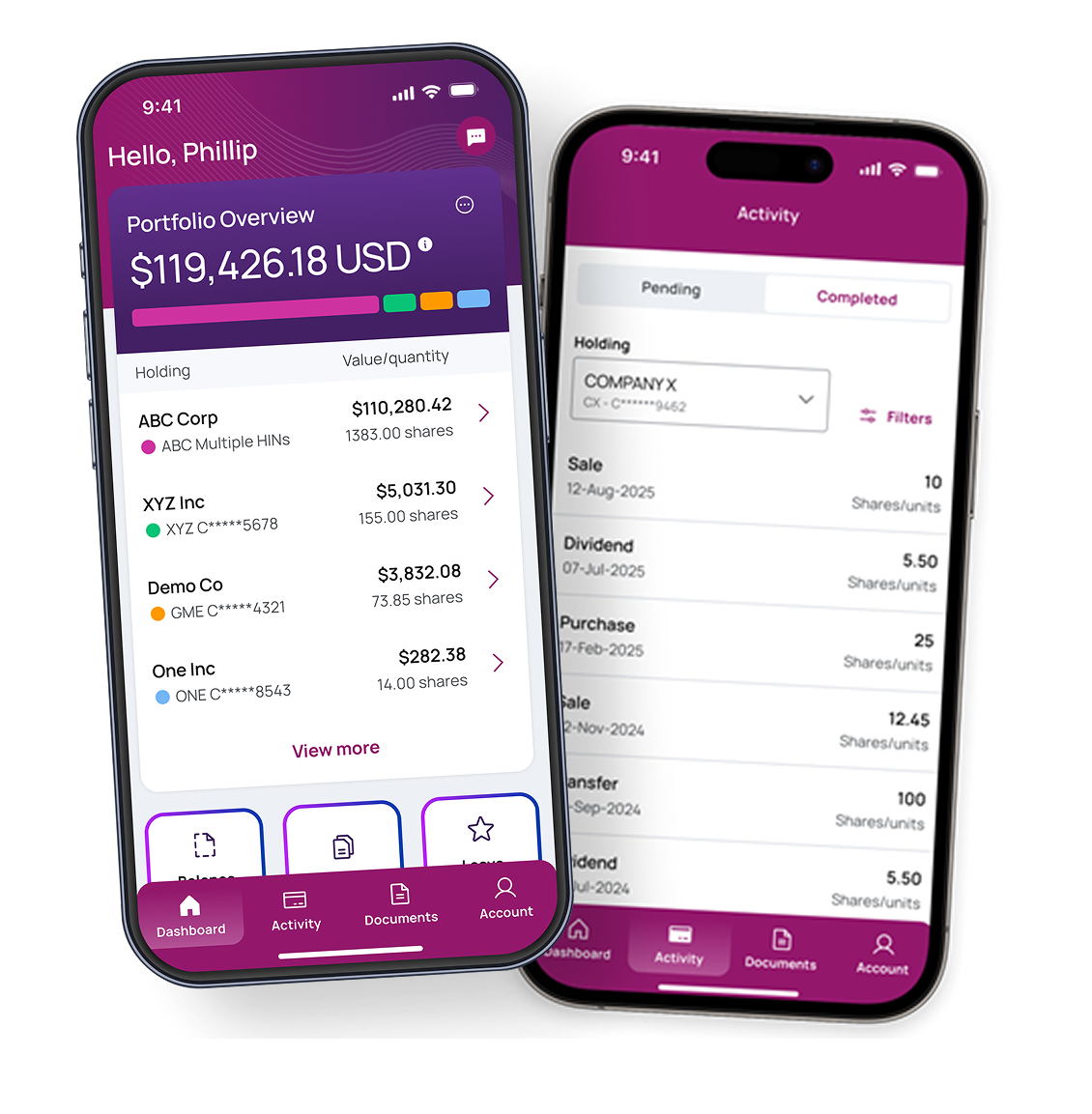

Simplify tax season – download the mobile app now

Instantly access your tax documents in one place for streamlined tax preparation. Get started by scanning the QR code or by tapping the links below.

Cost basis generally refers to the original value (usually the purchase price) of a security for tax reporting purposes, potentially adjusted for transactions that might occur after the purchase.

Shareholders have always been required to report cost basis on their individual tax returns. However, because of the Emergency Economic Stabilization Act of 2008, transfer agents such as Computershare are required to report cost basis for certain types of securities acquired after January 1, 2011 (January 2012 for Mutual Fund Shares), to both the security holder and the IRS.

Computershare will send you an IRS Form 1099-B that reports the details of your sale. The same information will be sent to the IRS. In addition, for share transfers to brokers, Computershare will furnish your broker with basis information on covered shares.

Covered means that transfer agents, such as Computershare, are required by the IRS to report cost basis to the individual and the IRS for such securities.

Any corporate stock and plan shares acquired on or after January 1, 2011, are considered covered. Mutual fund shares acquired on or after January 1, 2012, are also covered. Noncovered shares are shares acquired prior to the cost basis regulations taking effect for that type of security, or for security types that are not included under the cost basis reporting requirements.

Adjusted cost basis is a change to the initial dollar value of a security as result of financial transactions that impact that security. Other financial transactions can include, but are not limited to, fees, corporate actions, return of capital payments, and wash sales.

Partial sales, transfers, and certificate issuances will be processed using the First In, First Out (FIFO) method, unless you tell us otherwise. There are no additional instructions required from you for us to process your transaction using the FIFO method.

Cost basis reporting methods do not apply when transacting on your entire position. Cost basis calculation methods are only used when there is a partial sale, transfer, or certificate issuance by the holder. When a holder sells or transfers their entire covered stock position, the basis for the entire position is provided.

Instantly access your tax documents in one place for streamlined tax preparation. Get started by scanning the QR code or by tapping the links below.

Computershare is pleased to work with NetBasis, a Web-based service, to provide historical share price and corporate action information for many securities and mutual funds going back to 1925.

NetBasis contains information and tools to assist shareholders and financial professionals with information related to the cost basis of shares. Information is available for most stocks.

Note: NetWorth Services, Inc., a software company unaffiliated with Computershare, provides a software product named Netbasis that calculates cost-basis information. Netbasis incorporates changes caused by stock splits, mergers, and corporate actions, using it to deliver adjusted cost basis information. NetWorth Services charges a fee to obtain this information. Click on the link if you wish to obtain such information.

You will need to input either the common stock CUSIP number or the ticker symbol. You will be charged a fee for this service. Fee information is posted on the Netbasis website. Netbasis is not appropriate for calculating the cost basis of shares acquired through the demutualization of an insurance company. If you received your shares through a demutualization, please refer to the Company-Provided Information below or call the number shown on your account statement.

Netbasis is a trademark of The Depository Trust & Clearing Corporation and NetWorth Services, Inc.

FATCA stands for Foreign Account Tax Compliance Act, which was signed into law as part of the Hiring Incentives to Restore Employment Act of 2010. Its primary intent is to identify US taxpayers who may be owners of income or assets held outside of the US.

If your account is registered as an individual, foreign, or domestic, or as an entity with a valid W9, FATCA will NOT apply to you. If your account does not appear to be that of an individual and does not have a valid W9 on file, it can be presumed to be foreign, regardless of the address, then you may be considered a foreign entity and subject to 30% tax withholding for FATCA.

FATCA withholding is applicable to presumed foreign entities that do not have a valid IRS tax certification form on file. To update the tax status of your account, please complete a W8BEN form and return it to Computershare to update your account tax status. You may access IRS tax forms and information, including a W8BEN-E form, here.

If you are a shareholder of a Computershare-administered dividend reinvestment plan, you may access your statements and tax documents through Computershare’s Investor Center website. The Investor Center website also is a resource to find historical stock prices for companies that are Computershare clients.

Investor Center is a trademark of Computershare.

If you acquired shares through a Computershare-administered Employee Stock Purchase Plan (ESPP) or Stock Options Plan, you may access statements and tax documents through Computershare’s Employee Plan Participant Portal.

Note: If you are looking for cost basis information for an ESPP or Option Plan not managed by Computershare, check with your plan administrator or tax professional for assistance.