Offering an Employee Stock Purchase Plan (ESPP) your employees will want to participate in can have a profound impact on their lives and provide you with the ability to attract loyal employees and compete for the best and brightest talent. This important benefit and investment can come in many different shapes and sizes and designing one doesn’t have to keep you up at night.

This paper provides an overview of the necessary considerations to designing a competitive ESPP together with a summary of some of the most desirable program features in the marketplace.

Considerations in offering an ESPP

Needs will vary from one company to another, but there are common things that every company should contemplate after deciding to implement an ESPP — from setting program goals to making design decisions on plan features to determining success factors. Here are six key areas that should be carefully analyzed as part of the process.

|

Goals

- Employee Ownership2

- Identification with the company

- Incentivize/reward

- Competitiveness/retention

- Generate cash flow to the company

- Increase employee satisfaction/employee engagement

|

Compensation and Benefits Structure

- Other retirement programs offered

- 401k

- Pension

- Profit sharing

- Long & short term equity comp eligibility

- Employee ownership

- Competitiveness/Retention

|

Corporate and Employee Culture

- U.S. and/or non-U.S. employees

- Tax implications

- Global mobility tracking

- Locations

- Access to computers and emails

- Financial savviness

|

|

Design Decisions on Plan Features

- Eligibility

- Offering period length3

- Purchase period(s)

- Stock price and volatility4

- Contributions

- Via payroll deduction or in cash

- Flat dollar amount or percentage of pay

- Withdrawal/increases/decreases permitted and when

- Refund or rollover in extra cash

- Discount/match5

- Lookback6

- Other

- Holding requirement

- Full or fractional share

- Cash dividend or reinvestment

|

Corporate Benefits and Obligations

- Cash flow

- Tax deductions

- Share depletion

|

Success Factors

- Measuring and meeting company goals

- Ease of administration

- Employee communication

- U.S. and non-U.S. employees

- Employee participation = employee satisfaction

|

1 1 in 5 companies without an ESPP are considering implementing one. Source: NASPP/Deloitte 2017 Domestic Stock Plan Administration Survey

2 In North America, share ownership is the most important objective to implementing an ESPP. Source: Global Equity Insights Survey 2017

3 Six month offerings are most common, followed by three and one months; longer durations are on the decline. Source: NASPP/Deloitte 2017 Domestic Stock Plan Administration Survey

4 Monthly and quarterly purchase periods are most common amongst Computershare clients.

5 15% discount is the most common amongst Computershare’s clients.

6 32% of Computershare’s clients offer a lookback; 68% do not.

Some features of an ESPP are more important to its overall success than others. Recent survey data indicates that the following factors contribute to higher plan participation rates and more successful programs:

Factors that Contribute to Higher Participation Rates

- Offering period length7

- Contribution reductions permitted during offering7

- Offering a lookback7

- Discount amount7

- Automatic payroll contributions7

- Quick sale programs7

- Good communication8

- Clear plan design/rules8

- User-friendly platform/technology8

7 Source: NASPP/Deloitte 2017 Domestic Stock Plan Survey

8 Source: Global Equity Insights Survey 2017

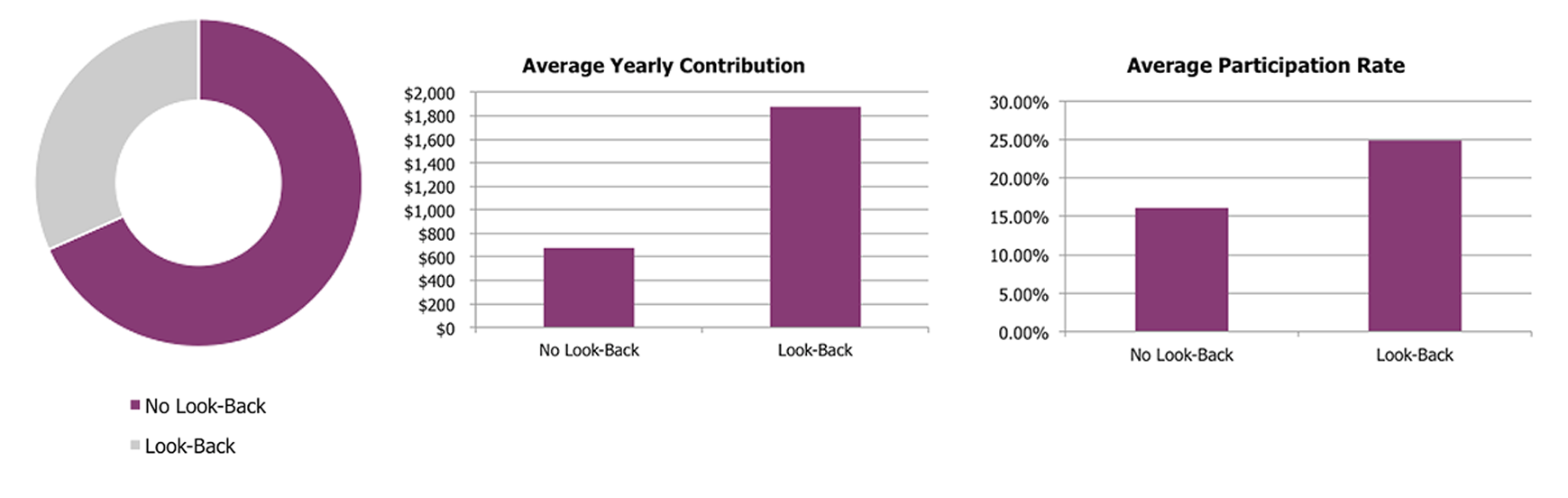

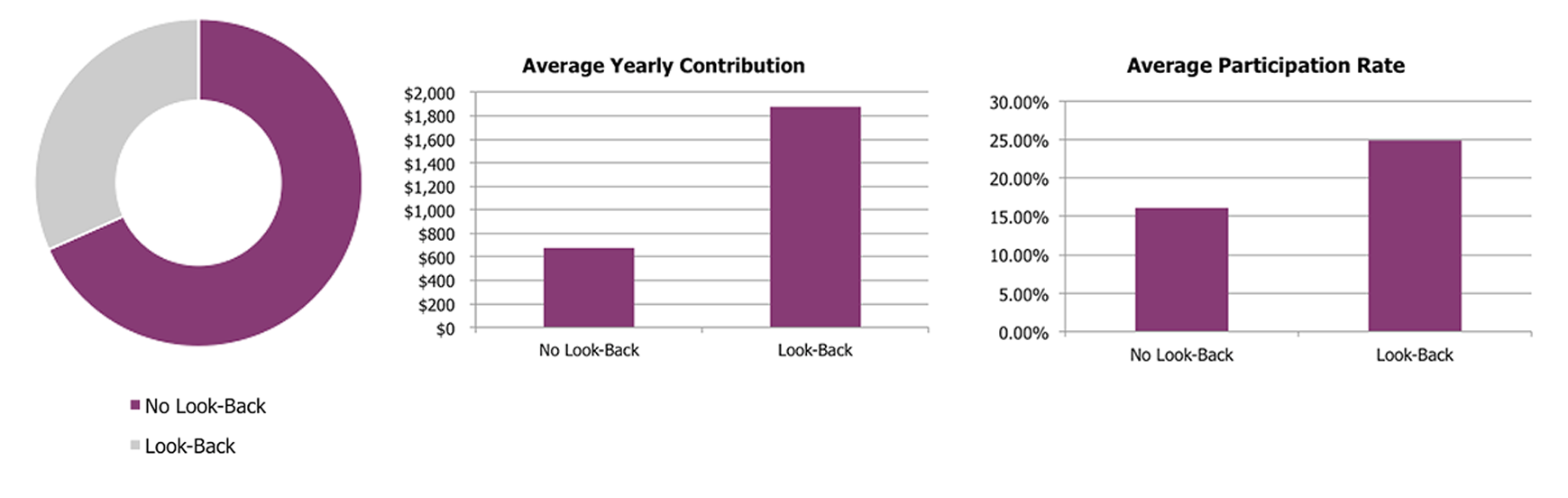

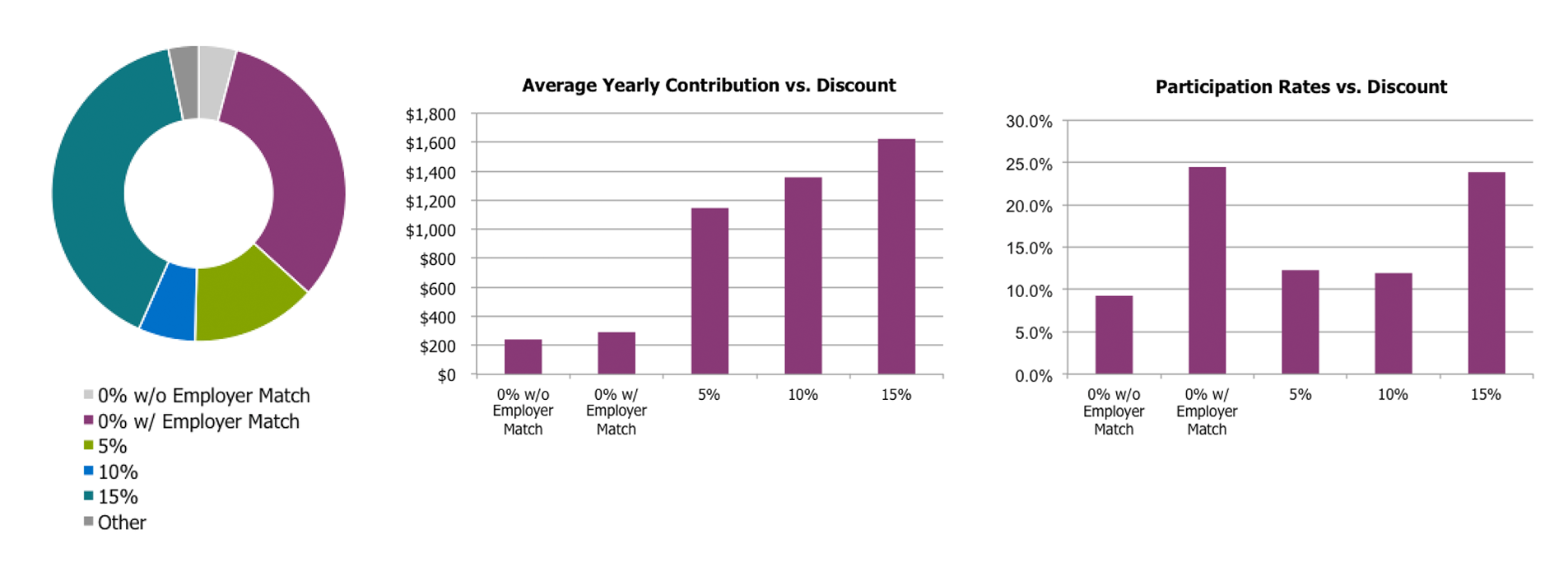

Consistent with the survey findings above, a recent study by Computershare and Aon that looked at ESPP participant behavior in the marketplace for 115 different companies in 186 different domiciles found that companies who offer plans with a lookback period see higher average contributions and participation rates.

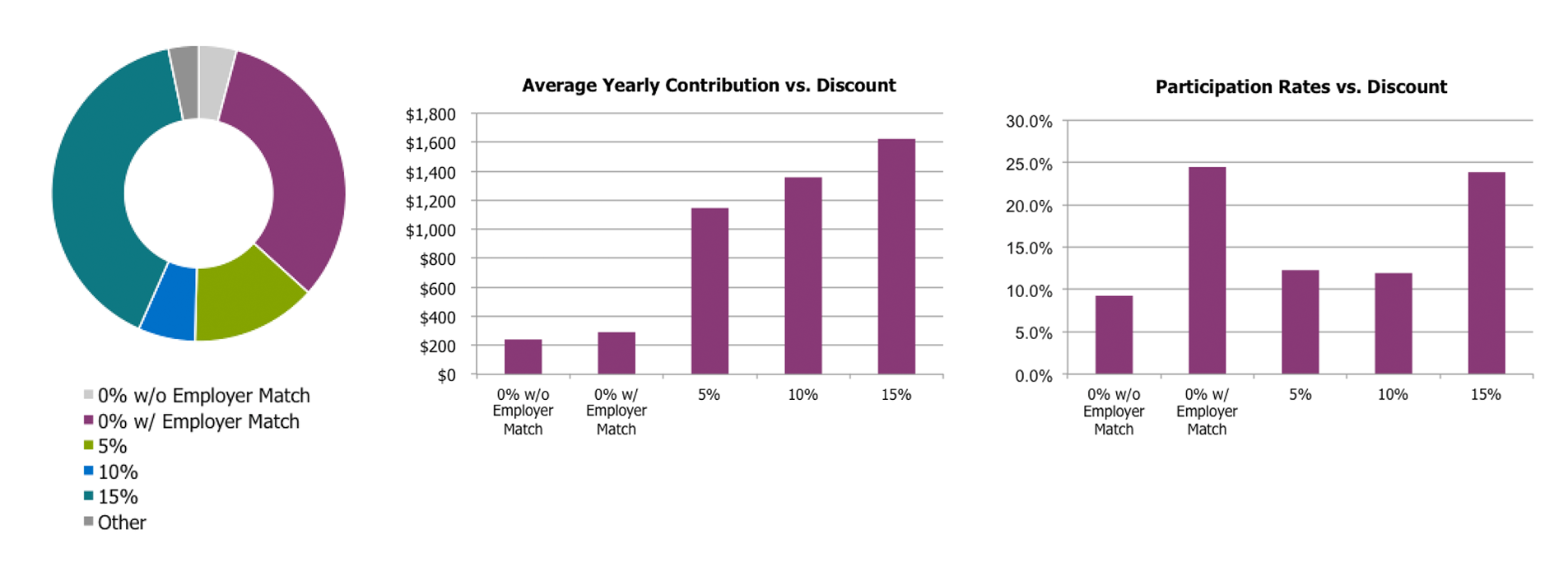

Further, companies that offer larger discounts under their programs see higher contribution and participation rates. The average annual contribution amount is almost 25% higher under plans that offer a 15% versus 5% discount and related participation is almost 50% higher.

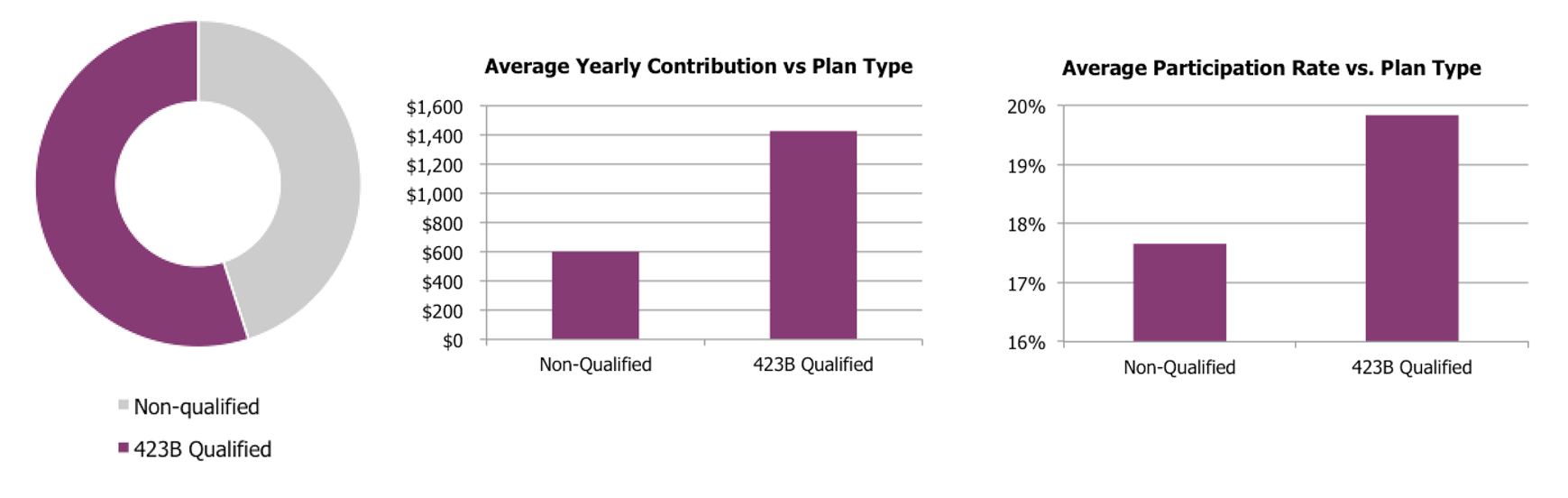

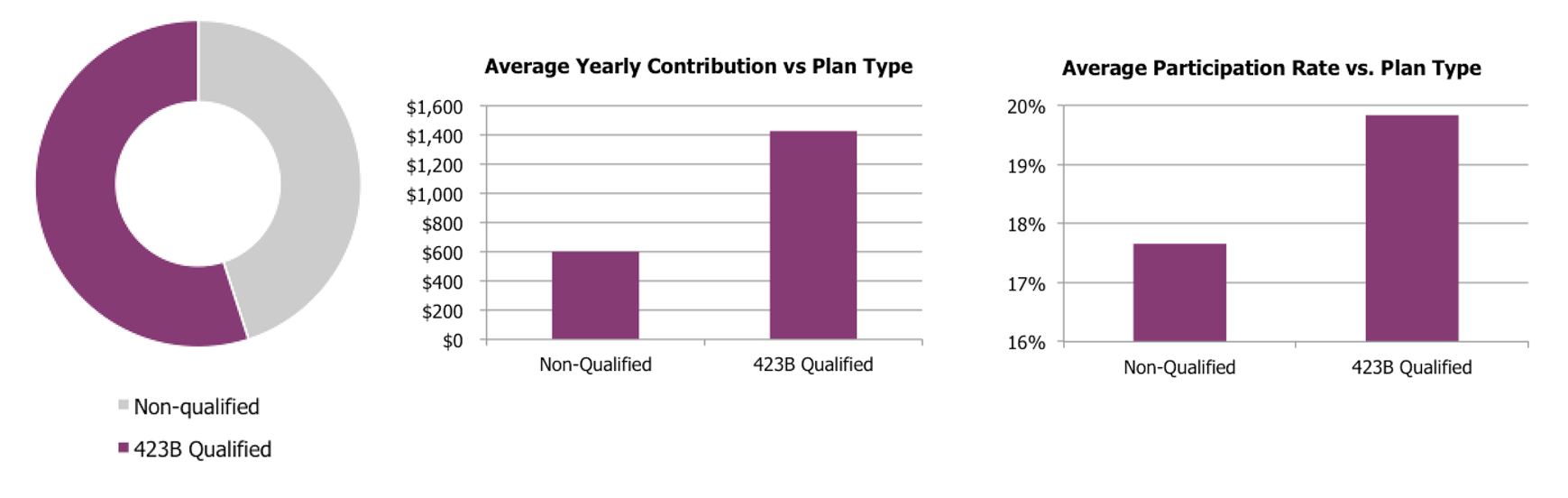

This same study suggests that qualified plans are more attractive to participants than non-qualified plans as qualified plans have significantly higher participation.

In conclusion

You don’t have to incorporate every favorable design feature mentioned here into your program, or offer a better program than other employers. What you do need, however, is to offer the right kind of program — one that meets the needs of your workforce and contemplates some of the most valued features in the marketplace and are known to be a significant drivers in participation, e.g., a discount and lookback. Do note, however, that this important investment may provide very limited benefits if it is not coupled with a strong communications program and a user-friendly tool for employees to participate in the plan.

Need help with your ESPP plan design?

Whether you're looking to launch a new ESPP or trying to improve the value of the one you have, we can help. Fill out the form below, and one of our plan design consultants will reach out to you shortly to help. Visit us at computershare.com/employeeplans to learn more.