Text messaging is fast, simple and convenient. It has become a preferred communication channel for many people, and we are looking to expand our text messaging options for your shareholders. Text messaging has the potential to increase efficiency and limit costs by letting shareholders get the information they need over the phone without speaking with a live agent or navigating an automated phone menu.

Our current SMS options allow holders to receive messages for a confirmation of sale, purchase of shares and transfer of shares. Holders also have the option of enrolling to receive future notifications, such as account alerts or transaction notifications.

Shareholders can sign up for this convenient service in a number of ways:

The future holds many potential uses for text messaging, including more transaction status updates (such as transfer confirmations), proactive communications related to accounts (such as uncashed checks or unexchanged shares), tax notifications and alerts regarding urgent conditions such as returned mail.

Text alerts are only available to U.S. shareholders with individual, joint tenant, or custodian for a minor account types and share balances greater than zero. The service will not be offered to institutional, trust, or other types of registered ownership, apart from individual, joint tenant, or custodian for a minor.

Here's a short Q&A about our text messaging capabilities:

What are the benefits?

The biggest shareholder benefits are timely communication via a preferred communication channel. For our clients, text messaging represents an opportunity to reduce more costly traditional back-office and communication practices.

What does it cost?

Computershare will not charge issuers or shareholders for sale notifications via text, though shareholders could incur data charges from their mobile telephone service provider. Computershare is absorbing the issuer cost for these text messages because they will improve proactive communication with shareholders and reduce telephone and correspondence activity (and the related costs).

What if the holder's mobile number changes?

Users can update their text-enabled telephone number via Investor Center, service rep or the automated telephone system for sales confirmations, as well as via Investor Center for all text messages.

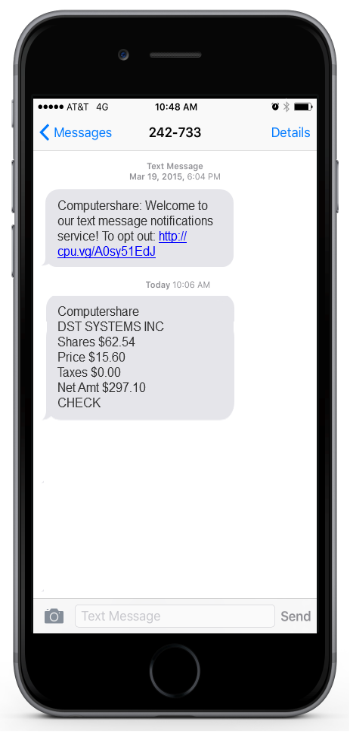

What do the text messages look like?

An example of the sales notification text message is provided below. Messages are short – a maximum of 160 characters – and where appropriate provide a link to take action or opt out of the text messaging service.

Can shareholders opt out?

They have the opportunity to opt out at any time via multiple channels: text, web, IVR or speaking to an agent. Where appropriate, the text communications will include a link to opt out.

Does anyone else do it?

Although text messaging is widely used within the financial services and other industries, we are not aware of any transfer agents offering this service.

Our current SMS options allow holders to receive messages for a confirmation of sale, purchase of shares and transfer of shares. Holders also have the option of enrolling to receive future notifications, such as account alerts or transaction notifications.

Shareholders can sign up for this convenient service in a number of ways:

- Our call center reps can enroll shareholders over the telephone.

- Certain clients' shareholders already have the ability to opt in to SMS our interactive voice response (IVR) telephone system and we will continue to roll that option out to additional clients.

- Shareholders can directly enroll via a prompt in the Investor Center website.

Text alerts are only available to U.S. shareholders with individual, joint tenant, or custodian for a minor account types and share balances greater than zero. The service will not be offered to institutional, trust, or other types of registered ownership, apart from individual, joint tenant, or custodian for a minor.

Here's a short Q&A about our text messaging capabilities:

What are the benefits?

The biggest shareholder benefits are timely communication via a preferred communication channel. For our clients, text messaging represents an opportunity to reduce more costly traditional back-office and communication practices.

What does it cost?

Computershare will not charge issuers or shareholders for sale notifications via text, though shareholders could incur data charges from their mobile telephone service provider. Computershare is absorbing the issuer cost for these text messages because they will improve proactive communication with shareholders and reduce telephone and correspondence activity (and the related costs).

What if the holder's mobile number changes?

Users can update their text-enabled telephone number via Investor Center, service rep or the automated telephone system for sales confirmations, as well as via Investor Center for all text messages.

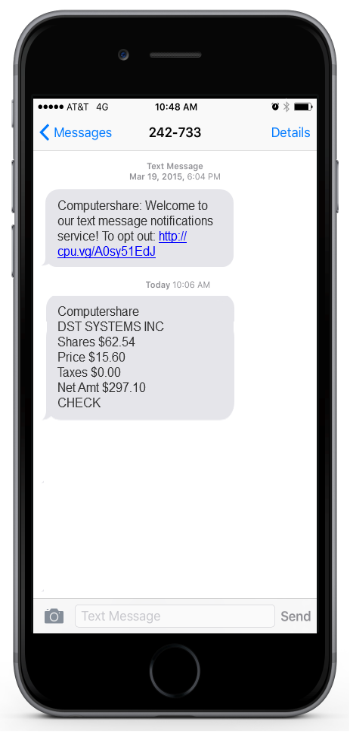

What do the text messages look like?

An example of the sales notification text message is provided below. Messages are short – a maximum of 160 characters – and where appropriate provide a link to take action or opt out of the text messaging service.

Can shareholders opt out?

They have the opportunity to opt out at any time via multiple channels: text, web, IVR or speaking to an agent. Where appropriate, the text communications will include a link to opt out.

Does anyone else do it?

Although text messaging is widely used within the financial services and other industries, we are not aware of any transfer agents offering this service.