Preparing for your IPO

Partnering with the right team of experts will ensure a smooth and seamless process for your listing.

Complex processes navigated with ease

Computershare will work closely with you and your advisors, providing guidance and expert advice throughout every stage of your IPO. Our teams’ commitment and unrivalled experience will ensure your IPO is seamless for you and your investors.

Experienced global partner with a strong track record

You will benefit from having an expert partner by your side. As an industry leader that has executed thousands of IPOs across the globe, Computershare will keep you on course.

Exceptional customer service delivered

Working hand-in-hand with a dedicated team of IPO experts, you’ll have access to highly experienced professionals.

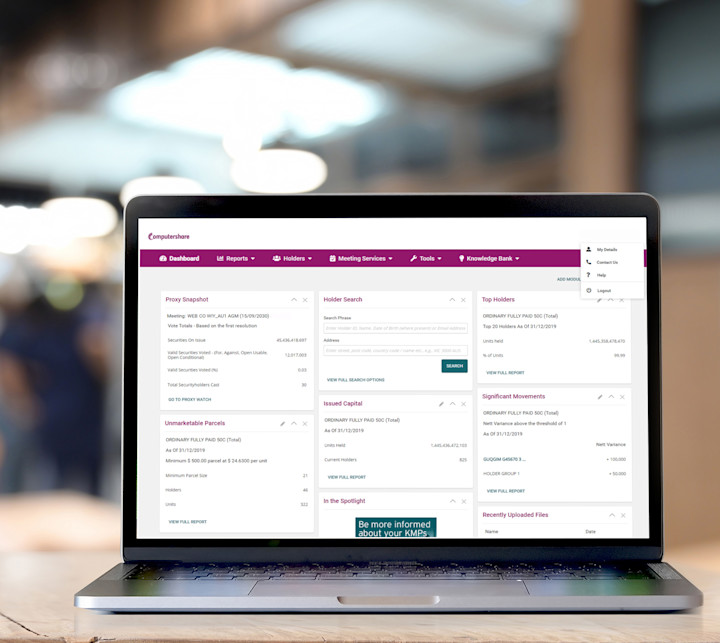

Innovative technology tailored to your needs

Computershare’s advanced digital platform, Investor Centre, offers your stakeholders self-service technology and a seamless user experience whilst reducing your ongoing costs. As a newly listed company, you’ll be able to manage your shareholder data securely and conveniently with our Issuer Online platform.

Support for your newly public company

Successful execution of your IPO transaction is just the beginning. With our foundations in share registry, and successful expansion into multiple industries including employee equity plans, stakeholder communications and corporate governance, Computershare will support your evolution as a public company.

Registry Services

Learn MoreYou’ll benefit from our decades of experience in share registry, our technology-enabled solutions, highly experienced people, and a suite of professional services tailored to your needs – all delivered with enhanced security.

Employee Share Plans

Learn MoreWhether you need an equity awards program or an employee share purchase plan, we administer the plan that is right for your company, and provide your employees with access to their holdings via our secure, web-based, employee platform.

Governance Services

Learn MoreWe can assist you with your corporate governance and compliance requirements through our integrated suite of governance solutions including company secretarial services, Board and Committee support, NZX liaison and NZX entity compliance services.

Moving forward with confidence

As you navigate life as a newly public company, you’ll take every step forward with confidence knowing Computershare has you covered with a wide range of solutions supporting your registry and governance requirements.

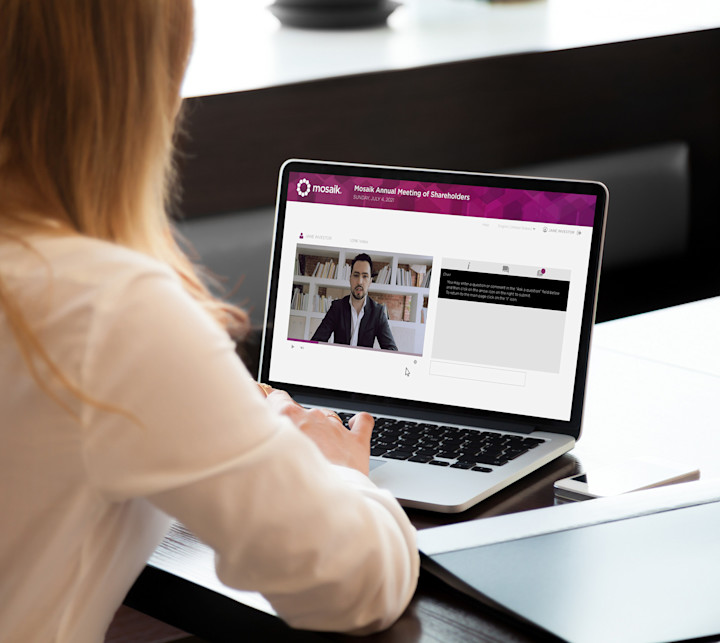

Annual meetings

Enable participation for issuers and shareholders in a meaningful, modern and digital way with Computershare’s virtual meeting solution. Whether you need a totally virtual option or simply a virtual component of your annual meeting, we provide strategies to broaden your shareholder engagement strategy.

Corporate actions

As you continue to grow as a publicly listed company, you may need a partner who can provide support for your future corporate activity. Whether it is access to capital, via shareholder capital raising, or mergers and acquisitions, by working with Computershare you have the support of a market leader with decades of experience managing every type of event and transaction, no matter how unique or complex.

Global capital markets

As you consider expansion into new geographies, having a partner with extensive access to global capital markets and expertise in jurisdictions worldwide is a big win. Whether you need to manage your listing in multiple markets, move securities across borders rapidly, or stay ahead of regulatory and market issues, Computershare has solutions to connect you and your investors to global markets.

Relationship Manager / Business Development Manager

Cassandra White

Cassandra works in the business development team at Computershare in New Zealand and has over 15 years’ experience working with clients across a range of roles responsible for securing positive outcomes. Her focus is supporting Computershare’s current clients while also building external relationships by developing proactive engagement with potential clients and industry intermediaries. Prior to joining Computershare, Cassandra spent 20 years working in the U.S and has partnered with some of the worlds most well-known brands such as Ford, Subaru, BMW Group and Mercedes-Benz.

Head of Clients and Business Development

Chris Woodhouse

Chris has been with Computershare since 2015 and leads our Client and Business Development teams. Chris and these teams are responsible for proactive engagement and relationship management with existing clients and the continual development of relationships between Computershare and potential clients and industry intermediaries. Prior to joining Computershare, Chris spent seven years working in the Investment Banking industry in the UK where he was involved in a variety of client focused roles.