Improving our service to you

In the last year we have launched two new services. The first is an Outstanding Payments Service. This reunites shareholders with any unpresented funds in their accounts, for example if they have forgotten to bank a cheque. The second is a new proxy voting platform, ProxymitySM, which has been developed in partnership with Citi. The service is an online platform that speeds up the transmission of meeting information and voting instructions between clients and their institutional investors. It also provides Issuers with greater transparency on how institutional shareholders have voted.

We also have several new products in development, including:

Updating our online services for shareholders to make it quicker, easier to transact via a mobile device and more intuitive for them to use

An improved operational process which results in the automatic electronic issuance of any outstanding payments to shareholders when a bank mandate is provided

Implementation of electronic remittance of sales proceeds for our postal dealing service as an alternative to cheque

Looking after you

We are committed to ensuring that our people are the best in the industry, and able to work with you as a trusted partner.

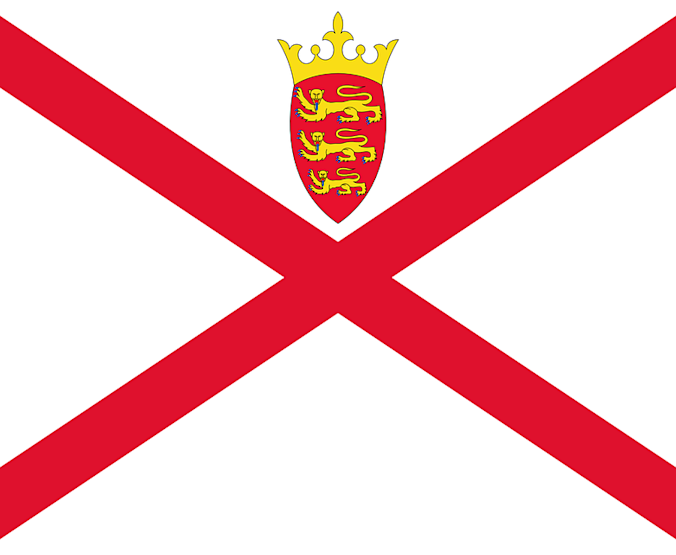

Each of our Client Managers has undertaken significant training over the past 12 months, and this will continue as part of our ongoing professional development programme. Like any business, succession planning is vital and to ensure we are well placed to continue supporting your future needs for the years ahead we have, over the last year, recruited a number of new Client Managers and Assistant Client Managers into the team from within and outside our business. We are delighted that our Jersey-based team picked up two awards at last year’s ICSA Jersey awards, which was a testament to the hard work and dedication they put into delivering an excellent service to clients, day in day out.

Looking after your shareholders

We know how important it is for your shareholders to be able

to manage their shares simply and efficiently. That’s why we are hard at work

behind the scenes on initiatives to continually

raise what are already industry-leading service levels experienced by

shareholders when they interact with us. Additional focus on coaching, support

and upskilling of staff is being used to help us answer shareholder queries

more effectively, reduce wait times and deliver increased satisfaction.

We recognise that at times of bereavement, shareholders

require additional support, so we developed our Estate Administration Service

to make it quicker and easier for the Estate to settle its affairs. We have

streamlined the process to make it easy to understand, and now offer an

enhanced service to those customers who want us to take on some of the administrative

burden.

We are proud of what we have achieved so far

We remained the registrar of choice for new listings across the globe, and the UK’s industry leading registrar whether for complex cross-border listings and corporate transactions or more straight forward single domestic listings.

In 2018:

We are delighted that so many of our clients have retained contracts with us over the last 12 months, and we are just as pleased to welcome so many new clients to our family recently as well.

2018 has been a positive year for our Offshore business and a year in which we saw a steady flow of new business, with Guernsey being particularly favourable.

Of particular note is the number of British Virgin Islands/Cayman/Bermuda incorporated entities re-domiciling in either Jersey or Guernsey. This trend reflects companies looking to take advantage of the flexible legislation and strong regulations in these jurisdictions.

In the last 12 months we have also seen very strong growth in our Irish re-domestication services, whereby companies choose to re-domicile to Ireland where we are able to assist them through offering Registry and Tax services.

If you are looking to undertake a corporate transaction of the nature described above, please don’t hesitate to speak to your Client Manager early in the planning process. Our experience will prove invaluable in ensuring that any such transaction is managed in the most effective way.

Influencing the industry

Alongside the provision of a high-quality service for our

clients, it remains essential that we are responsive and able to adapt to a

rapidly changing world. We are committed to investing in personnel, both

locally and as part of our global Issuer Services capability, to monitor

potential avenues for industry, legislative and regulatory change. We seek to influence

those developments where possible and keep our clients informed and engaged

where relevant.

Brexit is on the mind of most at the moment, and we are no

different. We have been heavily involved in industry groups and discussions, in

particular in relation to the implications for the provision of Central

Securities Depository (CSD) services in Ireland, where there is a resultant need

to replace the CREST infrastructure. We responded to Euroclear UK &

Ireland’s (EUI) consultation paper on ‘Potential Brexit Impacts: Irish

Securities Settlement and Euro Settlement’ and engaged with regulators and

stakeholders to push for grandfathering arrangement to allow time for proper

deliberation on the longer-term solution. We also responded to the draft UK

Statutory Instrument governing application of the CSD Regulation into UK law,

flagging some potential anomalies with HM Treasury and seeking clarity over the

application of CSDR post-Brexit.

Beyond Brexit, we have been working with Her Majesty’s

Treasury, the Department for Culture, Media and Sport and an appointed industry

champion on the proposed expansion of the Dormant Asset Scheme to include the

securities sector. We fed back to the

European Commission Expert Group developing the implementing acts linked to the

amended Shareholder Rights Directive, and are the sole registrar with

representation on several European working groups looking at the detailed

implications for market practice in relation to shareholder identification,

general meetings and company announcements.

The last twelve months have also seen a revised UK Corporate

Governance Code, a draft revised Stewardship Code and a debate on the ongoing

role of the Financial Reporting Council as part of a wider review of the audit

market. We will continue to monitor these developments and will provide

further information and support should it be needed.

Don't just take our word for it

In 2018, for the fourth year in a row, we were ranked the UK's leading registrar. Not only that, but we also achieved our best scores ever.

Our Overall Satisfaction score increased to 96%, up 3% on the previous year's score, and widens the gap with both our competitors, who are now 7% behind us.

We came top in all six major categories, and scored 100% in Service to Shareholders and in General Meeting Management.

- 2018 UK Stock Market Awards - Share Registrar of the Year

- 2018 Shares Awards - Best Share Registrar

- 2018 ICSA Jersey Awards - Governance Award of the Year and Risk and Compliance award

We are far from being complacent however, and hope that this summarised update on our activities over the last 12 months demonstrates our continued focus on delivering the highest quality service and enhancements that benefit our clients.