- Economic Crime and Corporate Transparency Act

- Extension of Payment Practices Reporting

- FRC Annual Review of Corporate Reporting

- FRC Report on Materiality Mindset

- FRC Statement on the New Corporate Governance Code

- Dividends in CREST

- Nature Action 100 Engagement Plans

- Proxy Advisors Asked to Improve

- FTSE 350 Remuneration Report

- Say on Climate Resolutions in Europe

- Corporate Governance 2024 ESG Webinar

- UK AGM Intelligence Report

Market Update

Economic Crime and Corporate Transparency Act

The Economic Crime and Corporate Transparency Act received Royal Assent on 26 October and this new piece of legislation will see amendments to the Companies Act 2006 which will, amongst other things, give Companies House greater power to query or reject information.

Many of the provisions are anticipated to come into force at a later date to allow companies – and Companies House – an opportunity to prepare for the changes that include the introduction of a new corporate offence for the failure to prevent fraud.

This legislation follows several consultations since 2019 and significant work in the last twelve months. The legislation includes the following elements:

- Companies House Transformation

The biggest change in the role of Companies House since its formation in 1884 will see it move from being a passive recipient of information to a gatekeeper. It will have the power to query any filings submitted to them, request further evidence, and reject filings as well as being able to remove information from the register more swifty. All information must now be filed electronically. - Identity Verification

All new and existing directors, people with significant control and those filing information to Companies House must have their identity verified. These checks can be done by registered formation agents or via an approved platform. It will be a criminal offence (prison sentence of up to two years) and risk a civil penalty (fine) for those who are not verified, and where a director is unverified the company will also be deemed to have committed an offence. - Corporate Criminal Liability for Economic Crimes

The legislation also sees a new strict liability corporate offence introduced of failure to prevent fraud where reasonable fraud prevention procedures are not in place. The legislation also amends the ‘identification doctrine’ where a company can be held liable for the acts of their officers and/or employees for economic crimes.

It is also anticipated that a prohibition on corporate directors will be brought into force through one of the commencement orders that will follow this legislation’s introduction.

Many of the provisions of the legislation will come into force at a later date to allow time for implementation and Companies House has recently noted that some measures will need processes to be established and secondary legislation. Other measures can be introduced far sooner such as Companies House’s ability to query or reject information. Those earlier measures could be introduced in early 2024, with others later in the year or even in 2025.

Computershare’s viewWe’ve been monitoring this legislation since its early inception and looked at elements of the planned reforms in the May 2022 Governance Readout.

We have been working with representatives of the Department of Business to remove or amend some of the more erroneous original drafting and significant amendments that we saw being introduced as the legislation moved through the parliamentary process. This included reducing the impact of an early draft that would have seen all companies needing to maintain additional information on their members/shareholders, but now it’s only applicable to those companies who are not listed or quoted, and the removal of a requirement for companies to maintain a list of all of the beneficial holders who sit behind nominees on their register of members.

Companies House confirmed that the identity verification and authorised corporate service providers will require new secondary legislation and guidance, as well as system development. As a result, the requirements for companies and directors, or even the effective date, are not yet clear.

It’s worth companies being aware that there are still changes beyond what most law firms are focusing on, including:

- Register of Members for all companies must have a full name (forename & surname) of the member. Initials will no longer suffice (e.g. Joe Bloggs and not J Bloggs).

- Any company that isn’t listed or quoted will need to record the date that a change which the member has informed them about occurred, and not just the date the register of members was updated (e.g. the date a member moved house, not just the date they told the company or their agent).

- Members who must provide additional information may be committing an offence if they do not update the company of changes within two months of them occurring.

- All companies will need to provide a list of any member holding 5% or above of the issued share capital at their next annual confirmation.

We are conducting a thorough review of the legislation and in due course will release some more information to aid companies in navigating the potential impacts.

It’s also worth noting that whilst more rigorous approaches to fraud prevention are welcome, we would be unsurprised if we see more boilerplate policies come into existence. Good governance is about the effectiveness, not just the existence, of appropriate policies and procedures.

- Companies House Transformation

Extension of Payment Practices Reporting

The Department for Business and Trade announced plans to publish a ‘Prompt Payment & Cash Flow Review’, and its intention to extend and improve the Reporting on the Payment Practices and Performance Regulations 2017 (the ‘Regulations’). The announcement follows the government’s statutory review of the Regulations, which noted that this provision provided greater transparency and symmetry to the payment practices and performance of large businesses, however there was further progress to be made. The government announcement confirms that it will extend the Regulations and introduce new metrics for reporting, including a value metric for invoices paid late and a disputed invoices metric.

The Regulations require entities within scope to produce a report on their invoice payment practices every six months and submit the report to a government-hosted website for publication.

Computershare’s viewDespite the governments review it remains unclear that the current payment practices reporting regime, or that this extension and addition to the reports, has supported better payment culture and met the intention to improve cash flow in SMEs. Meanwhile, the collation and reporting of a company’s invoice and payment information for each six-month period has caused considerable bureaucracy for many companies and entails additional reporting burdens.

Companies in scope of the reporting should ensure controls are in place to capture the data needed to produce and report on the additional metrics, including updating existing data capture processes to support efficient reporting.

FRC Annual Review of Corporate Reporting

The Financial Reporting Council (FRC) recently published its annual review of corporate reporting for 2022/23. The FRC review found that companies are faced with the impacts of interest rate increases amidst persistent inflation and uncertainties arising from climate change and the transition to a greener economy. Despite these headwinds, the review identified that the standard of reporting had largely been maintained.

The FRC reported on its disappointment in finding errors in financial statements as well as strategic reports which should be ‘fair, balanced and comprehensive’, cash flow statements, financial instruments and deferred tax assets, section 172 statements and TCFDs.

Computershare’s viewCompanies and auditors should make themselves aware of the thematic areas of improvement identified by the FRC and adopt improvements through the financial and non-financial reports.

It is increasingly important that annual reports comply with relevant requirements and also offer high quality information for stakeholders, in particular investors. The disclosures should include assessments of the principal and evolving risks with clear explanation of the impact on the company, as well as the considerations and outcomes of the Board’s oversight.

FRC Report on Materiality Mindset

The Financial Reporting Council (FRC) recently published a report to enhance the approach to materiality in corporate reporting. The report encourages companies to adopt a holistic approach to materiality by connecting quantitative, qualitative and sustainability-related information, and to focus on key issues across the three horizons.

Computershare’s viewThe additional guidance for companies to support their approach and assessment of materiality will be welcome, in particular for narrative and sustainability disclosures which may not have a financial threshold. Preparers of corporate reports should make themselves aware of the report and consider the materiality approach to improve the quality of disclosures for the benefit of stakeholders.

FRC Statement on the New Corporate Governance Code

The Financial Reporting Council (FRC) released an update on its plans to refresh the Corporate Governance Code, which is now expected to be published in January 2024. The FRC also made known its intention to not pursue the majority of the proposed changes, but will continue with changes that streamline and remove duplication, and those related to internal controls. The update follows His Majesty’s Speech to Parliament which announced that legislation on corporate reporting and audit reform had been de-prioritised.

Computershare’s viewThe reforms over audit legislation and the Code have been long-awaited and having clarity over their status will be welcomed. The de-prioritisation of audit legislation and the reduction of the proposed changes to the Code, in particular for those on internal controls, may be a relief to companies given the burdensome proposals contained within them.

Computershare will be reviewing the progress of the new Code and will comment further.

Dividends in CREST

Following months of work with members of CREST to ensure the capability to receive GBP dividends via the CREST system, Euroclear UK & International has recently announced that the option to elect for payments to be paid outside of the CREST system will be removed early in 2024.

From the perspective of issuers, Euroclear will be encouraging payments via CREST functionality if not already adopted. For the remainder of the year and ahead of the mandatory enforcement date, Euroclear will continue to encourage early adoption.

Computershare’s viewWe have long supported issuers in adopting this functionality and continue to see issuers amending their agreements where needed so that they can make dividend payments to their institutional investors in the most efficient and environmentally friendly manner possible.

We anticipate that this move to mandatory enforcement of CREST payment elections is likely to result in additional pressure on all issuers to utilise this payment channel. If you are not sure if you currently utilise this functionality when making dividends payments or wish to find out more, please contact your Client Manager.

The benefits of making dividend payments to your institutional investors through the CREST system can:

- Contribute to the ESG targets of your organisation through a reduction in issuing paper cheques and dividend confirmations.

- Reduce risk as payments made through CREST are backed by Central Bank Money.

- Remove the need for institutional investors to request replacement payments.

Nature Action 100 Engagement Plans

Nature Action 100, the initiative established to drive greater corporate ambition and action to reverse the loss in biodiversity globally, has released their target list of organisations they will seek engagement with via their institutional investor partners.

The initiative aims to work with institutional investors so that it can engage with organisations on a common high-level agenda for conversations that set out clear expectations to drive businesses’ actions to stem nature and biodiversity loss.

The 100 companies within key sectors that have been identified are deemed to be systemically important in reversing nature and biodiversity loss by 2030. The principles used to identify companies were:

- The company is within one of the key sectors deemed to be systemically important in reversing nature loss.

- An analysis conducted by the Finance for Biodiversity Foundation indicates the company has a high potential impact on nature.

- The company has a large market capitalisation within the sector.

- The selected companies represent developed and emerging markets.

Companies identified include Anglo American PLC, BHP Group, Glencore, Rio Tinto and Unilever.

This initiative is linked to the Climate Action 100+ and both initiatives have many similarities. For instance, whilst the Climate Action 100+ focuses on the 2015 Paris Agreement of limiting temperature increase to 1.5°C above pre-industrial levels, Nature Action 100 focuses on the agreement at COP 15 last year to halt and reverse biodiversity loss by 2030.

Investor signatories are expecting companies to have a 2030 ambition in line with the COP 15 agreement, assess impact on ecosystems, set quantitative targets, implement initiatives to achieve targets, establish board oversight and engage with external parties throughout value chains.

Computershare and Georgeson’s ViewThis is a signal from the investor community (and more specifically the European investor community) that it has started its focus on biodiversity and nature-related issues.

Indeed, we have seen reports that a wide number of Nature Action 100 (NA100) investor signatories intend to engage with at least 6-10 of the target companies while other reports have indicated that there are more than 50 companies they plan to engage with, mostly in the UK and Europe. It is anticipated those companies in the food, biotechnology, and pharmaceutical sectors are the most common targets for members of the NA100. Some actions could include filing shareholder proposals where companies have not been responsive to engagement.

Whether this will influence companies outside of this initiative is a different question, but there is concern amongst the investor community that companies are failing to have appropriate oversight of biodiversity and nature-related risks.

However, this initiative is in its very early stages, and it is unlikely that we will see shareholder proposals related to this topic in Europe over the next year or so. As standardised reporting for this topic develops (with the introduction of the CSRD standard for biodiversity and the potential that the ISSB will produce a biodiversity standard) then expectations on companies outside of this initiative will begin to grow.

Therefore, although the actions below are for those companies who have been identified by the NA100, those outside should consider these steps in the short-medium term:

- Assess the company’s practices as compared to peers and the aforementioned investor expectations.

- Conduct a gap analysis of the company’s current reporting practices against the recommendations of the Taskforce for Nature-related Financial Disclosures (TNFD).

- Formulate a transition plan that minimises the financial risk to the company.

- Engage with investor signatories to ensure you clearly communicate your current practice and how these issues are being managed by the company.

You can also request Georgeson’s latest memo on the Nature Action 100 initiative.

Proxy Advisors Asked to Improve

The 12-member Independent Oversight Committee (IOC) of the Best Practice Principles Group for Shareholder Voting Research (BPPG) have released their latest annual report.

The majority of the report lays out the work of the BPPG and the IOC and includes information on the best practices that have been set as industry standards. It also considers how proxy advisors EOS, Glass Lewis, ISS, Minerva and PIRC have done against the best practice industry standards for service quality, conflicts and communication.

The report sets the direction of travel for the forthcoming year, prioritising improvement around Principle 1 (Research Capacity) and Principle 1 (Quality Assurance). Being clearer within their reports on their revenue sources so that those assessing potential conflicts that signatories may have, can identify links quicker and improve complaint procedures.

FTSE 350 Remuneration Report

The Georgeson Governance/ESG team released an overview of FTSE 350 remuneration report votes that received more than 20% opposition during the third quarter of 2023.

They note that during this period, 83 of the FTSE 350 held their AGM and three of these issuers received less than 80% support for the approval of their remuneration report.

You can read the memo here.

Say on Climate Resolutions in Europe

Georgeson’s Daniele Vitale and Hal Dewdney’s article “Say on Climate resolutions in Europe during the 2022/2023 AGM Season” features in Governance Magazine’s September Issue.

“The 2023 AGM season marked the third year that companies voluntarily put forth Say on Climate resolutions in Europe. The season (1 July 2022 to 30 June 2023) revealed some notable trends that offer valuable insight into the climate commitments and actions of European companies. For example, 24 companies across Europe presented board-sponsored advisory resolutions relating to their climate disclosures and action plans at their AGMs”.

Corporate Governance 2024 ESG Webinar

Georgeson’s Cas Sydorowitz is joining Hogan Lovell’s ESG webinar titled ‘Corporate Governance 2024’ on 22 November.

You can register for an analysis of the essential hot topics to consider in advance of your 2024 AGM. The webinar will provide expert insight and commentary on the latest market trends, key activist campaigns and other important global developments which are relevant to boards and investors.

They will cover:

- The health of the UK markets – the investor perspective.

- Voting trends in 2023 and our predictions for 2024.

- ESG activism – the past, present & future.

- Key regulatory changes on the horizon.

UK AGM Intelligence Report

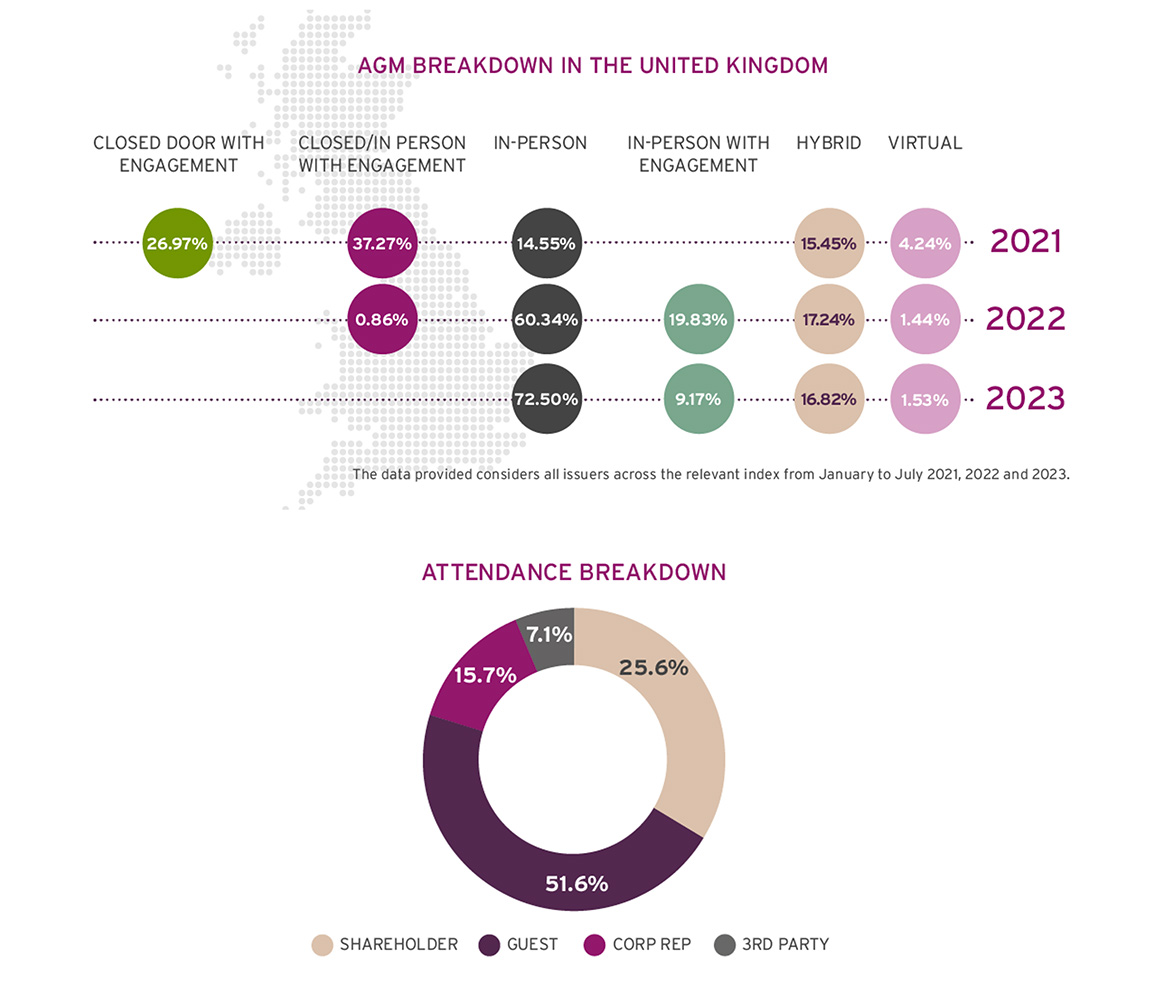

We are pleased to share our 2023 UK AGM Intel Report.

This year, we partnered with our UK clients to deliver 484 meetings, uniquely positioning us to provide meaningful insight to enhance your future meeting preparations.

Our report examines key themes, trends and developments seen during the UK 2023 AGM season, shining a spotlight on meeting formats, attendance and investor voting - as well as the use of different voting channels.

Here is a snapshot of some of the insights you will find in this report:

We are committed to deliver industry insight that supports your AGM preparations and would welcome your thoughts on this report as we head into the 2024 meeting season.

Alongside our virtual/hybrid meeting technology, our unique blend of registry, proxy solicitation and CoSec experience will deliver the investor and market insights you need along with the expertise and technology to execute your meeting. This way your Board, shareholders and advisors feel engaged and prepared for all eventualities as you head into your AGM.

To comment or register an interest in any items discussed above, or register an interest in any sessions referenced above, please email us at: IssuerMarketInsights@computershare.com.

All comments received will be kept entirely confidential and unattributable and we will not use your details for any marketing purposes.

News and insights

Stay up-to-date with our latest news, events and blogs

Governance Readout archive

Take a look at our previous editions of the Governance Readout.

Georgeson News

Want to receive news on Georgeson and our markets?