A range of solutions

Who we are

Our data solutions

Enhancing your client's experience

Our range of solutions can help you with the following:

Respond to regulatory change far quicker

Our solutions are designed to take our clients away from legacy to accurate and agile

Multi-channel output

Delivery of client specific communications, to any device in any format

Data Aggregation

Automation and aggregation of data from external and internal sources without the need to re-platform

Automation

Automated inclusion of client specific content to enrich communications

Operational efficiencies

Reducing operational costs or improving efficiencies through automation

Innovation

Innovation of client communications

Outsourcing

Outsourcing of non-essential activities like regulated client performance communications through strategic co-sourcing to a trusted partner

Document change management

Self-serve or managed service change document composition for ad-hoc or enterprise wide change management

Find out more about our communication solutions

Get in touch

Want to know more about who we are?

In the UK, we are regulated and approved by the FCA and manage:

- Millions of customer interactions/communications per annum across hard and soft copy output

- £1.3 trillion of UK Gilts

- £134 Billion annual payments of Gilts per annum

- £62bn mortgage assets under management across 225,000 clients

- 100 million user accounts managed on proprietary digital channels

- 1.1 million active tenancy deposits

- Multiple legacy systems

- 25 million holders/participants in Computershare’s back-end system SCRIP

- £250 million of childcare vouchers issued last year

Why us?

*(information correct as of March 2019)

What sets us apart

› Our solutions are designed to be quickly deployed with minimal disruption to your business.

› We have commercial models designed to suit the needs of our clients as either Op –Ex, Capp-Ex or a SAAS based model.

Are you looking to improve your client performance reporting, digitise client communications, or simply look for cost and process efficiencies?

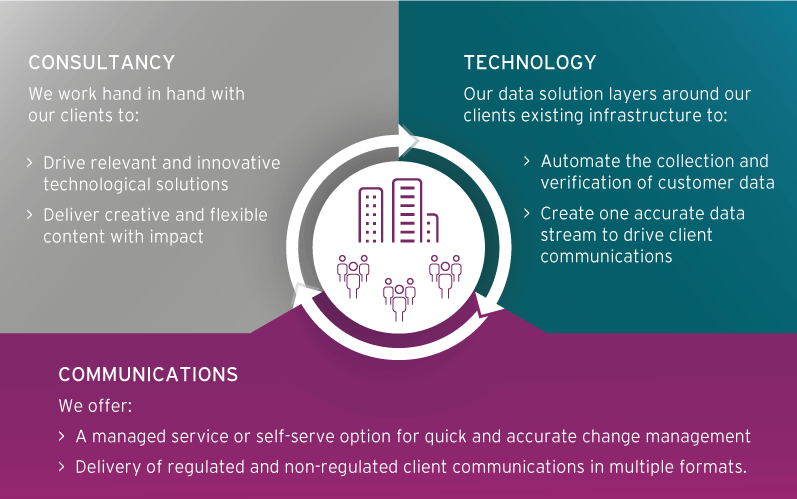

Our experience suggests when looking at improving client communications and digitising performance reporting there are two key points to address

Data

Composition

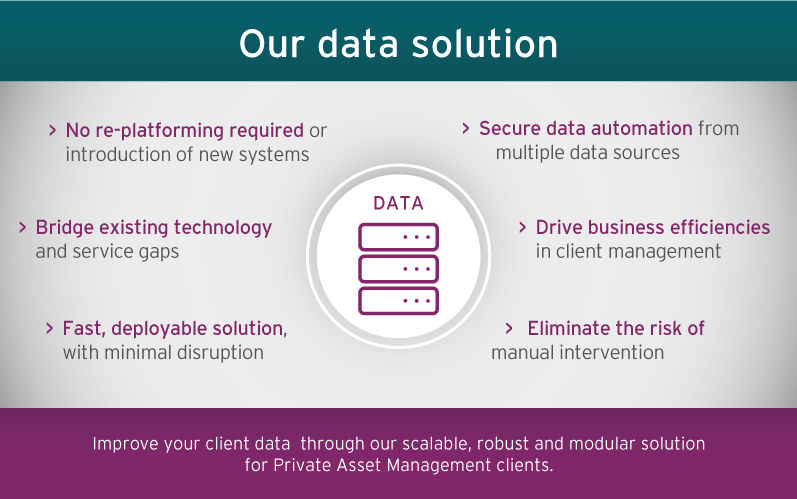

Data - the collection and verification of data from multiple sources

In a recent report from WealthBriefing titled ‘Client Reporting: Regulatory Burden or Client Engagement Tool’, of the companies interviewed 29% from the Private Asset Management sector used five or more systems to construct, manage and report on client portfolios.

The issue of client data collection, overlaying transactions, fees, portfolio performance and verifying its content from multiple systems, is a complex, time consuming, resource heavy process. To address this issue we have:

Our solution means our clients do not need to re-platform or change systems. This is a significant improvement when compared to the potential disruption and cost often associated with such considerable change.

Composition - enhancing your client’s experience through the delivery of engaging, flexible and relevant communications.

Client's performance reporting preferences are as unique as the investors themselves. Private Asset Management companies are left to balance a range of competing requirements as they look to define what is suitable and appropriate.

Recent regulatory change has increased the frequency of reporting and associated costs of delivery amongst other things. Private Asset Management companies are looking for ways to digitise communications, enhance processes, increase relevant content and demonstrate value.

Flexible communications

Designed to work with our clients' existing systems and or the CCS data tool to increase the flexibility of communications.

Managed service or self-serve

We can offer a Self-Serve or Managed Service option for swift and accurate document Change Management across ad-hoc documents or across a suite of templates. With centralised control management and version control of all output.

Controllable communications

Delivering customised client communications across conventional and digital outputs.

Automated process

Automated management commentary with centralised workflow and business rules approvals, can reduce the costs associated with manual creation and a multi-person approval process

Complete document retrieval, storage and archive

Store a copy of all documents, which can be easily accessed at all times, creating a clear audit trail and customer specific MI.

If you'd like to know more about how our Wealth and Private Banking communication solutions can help you and your business, please fill in your details here.