Over the past month, Computershare held a series of events titled "Trends and market insights into employee share plans in Asia". These events included an in-person seminar in Shanghai as well as webinars conducted in Cantonese and English. During these sessions, we conducted in-depth discussion on topics related to equity incentives, designed to help companies improve their employee share incentive management. These events integrated theory with practice and attracted hundreds of participants. We would like to thank all participants for their attendance.

The topics discussed included:

- Findings from our latest research report in Asia

- Trends of Employee Share Plans in Asia

- Emerging Share Plan Types – Employee Share Purchase Plans

- Amendments to Chapter 17 of the Listing Rules by the Stock Exchange of Hong Kong

Event summary and highlights

Our speakers focused on sharing the major trends in the Employee Share Plan market in Asia, and the associated impact of the Hong Kong Stock Exchange (HKEX) amendments to Chapter 17 Listing Rules and provided participants with practical insights. We shared that year-on-year, we have witnessed a significant increase in the amount that Asian companies are investing into their employee share plans, and interestingly the number of overall plan participants is also growing.

Speakers

Thomas Cheung |

Cliff Huang |

Elise Xu |

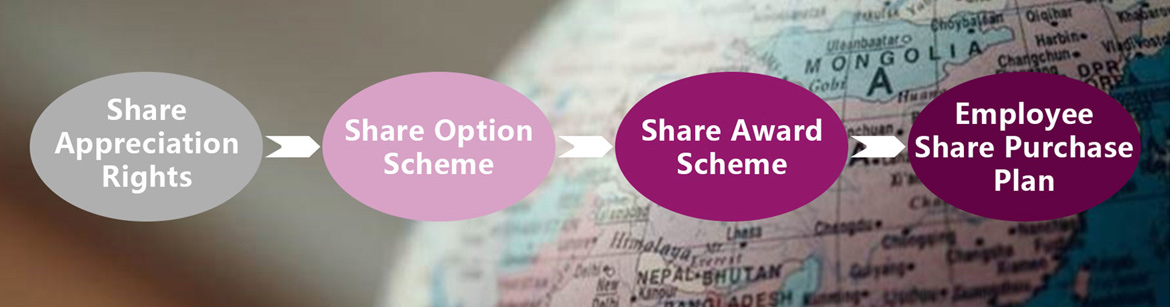

In addition, the most common plan type has changed from the Share Appreciation Rights (SAR) to the current Share Option Scheme (SOS) and Share Award Scheme (SAS).

We are now seeing Employee Share Purchase Plans (ESPPs) gain popularity in the market and as such, they are set to become the mainstream option for companies in the future.

Compared with other plan types, employee share purchase plans have many advantages including (but not limited to):

- Voluntary participation by all employees

- Part of employees’ long-term savings

- Direct employee investment into Company’s shares

- Dollar cost averaging

- Payroll contribution in affordable amounts

- Opportunity for employees to invest offshore

Find out how your company can set up an ESPP here

In addition, we explained the key changes to Chapter 17 Listing Rules, including the requirements that apply depending on how a company sources its shares. Importantly, we also provided practical examples of how the changes affect companies in various scenarios. Not only do the changes apply to Share Award schemes in many ways, Share Option schemes are also impacted, as the source of underlying shares are often newly issued capital.

The audience had many questions about this topic, and given the effective date of 1 January 2023, we encourage you to review how these changes apply to your organisation. Please contact us if you need any support via hkplanmanagers@computershare.com.au.

About us

Computershare Plan Managers has a team of 1,500 experts worldwide and is trusted by 1,700 clients to manage 5.3 million share plan participants across Asia, Europe, and America. Under our "one-stop" management model, companies and employees can reduce effort and save time.

With more than 40 years of experience, we are committed to sharing insights into many aspects of share plans including, plan design, multi-jurisdictional share plan management, financial reporting services, trust set-up and management, multi-jurisdictional income exchange, executive services and more.

If you missed our seminar, or are interested in participating in the next event, please contact us at hkplanmanagers@computershare.com.au.