Glossary

TIN (US Taxpayer Identification Number)

A TIN is a Social Security Number (SSN) issued by the Social Security Administration (SSA) or an Employer Identification Number (EIN) issued by the IRS. For security purposes, Computershare truncates your TIN displayed on 1099 tax forms received.

Cost basis

Cost basis generally refers to the amount you paid to purchase the shares. In line with IRS instructions, we will always report the cost basis in US currency on your Form 1099-B in Box 1e ("Cost or other basis"), by applying the average mid-market FX rate at the date the shares were acquired.Backup withholding

Backup withholding is a US withholding tax that is applied by Computershare on any dividends, or sales proceeds to US participants who have not certified their Taxpayer Identification Number (TIN) through completing a Form W-9. Tax withheld due to backup withholding can be credited against your tax liability on your U.S. income tax return.

“Covered” shares

"Covered" shares are those for which the plan administrators, such as Computershare, are required by the IRS to report the cost basis to the individual and the IRS on Form 1099-B for any sales of covered shares.

Any equity plan shares acquired for cash on or after January 1, 2012, will be considered covered.

“Non-covered” shares

"Non-covered", or "Uncovered", means that cost basis record keeping is not required of plan administrators for such shares under the existing law. However, the US participant is still responsible for calculating the cost basis for their individual tax returns.

Non-covered shares include plan shares acquired before January 1, 2012 and shares not acquired for cash. For example, shares acquired as a result of a restricted stock unit vesting will be considered non-covered, as they were not acquired for cash.

“Wash sale”

A wash sale occurs when you sell or trade shares or securities at a loss and within 30 days before or after the sale you:

- Buy substantially identical shares or securities,

- Acquire substantially identical shares or securities in a fully taxable trade,

- Acquire a contract or option to buy substantially identical shares or securities, or

- Acquire substantially identical stock for your individual retirement account (IRA) or Roth IRA

You cannot deduct losses arising on a sale in the event of a wash sale (see Form 8949 FAQ below). The disallowed loss is added to the cost basis of the shares repurchased. Computershare only tracks and reports disallowed losses from wash sales of covered securities occurring in the same account. The disallowed loss we report is based on the cost basis we are required to record, which has not been adjusted for any compensatory income recognized on the award. (See Cost Basis section below).

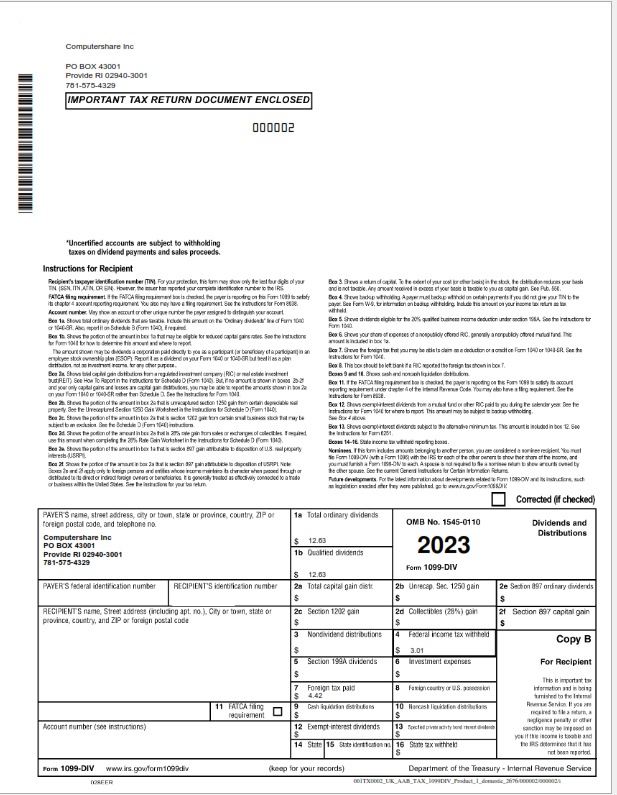

Understanding your Form 1099-DIV

What is a Form 1099-DIV?

A Form 1099-DIV "Dividends and Distributions" is a yearly tax statement provided by Computershare to US plan participants detailing dividends and other distributions paid to them during the tax year ended December 31 2025.

We are required to provide a Form 1099-DIV to both you and the IRS to comply with our reporting obligations.

What information is reported on the Form 1099-DIV?

The Form 1099-DIV will report the following information:

- Name of recipient

- Address

- Taxpayer identification number (TIN) of recipient

- Ordinary dividends

- Total capital gain distributions

- Qualified dividends

- Non-dividend distributions (return of capital)

- Federal income tax withheld (i.e. backup withholding)

- Foreign tax paid (where relevant)

Who receives a Form 1099-DIV?

You'll get a 1099-DIV each year you receive a dividend distribution. However, if the amount received is less than $10 for the year, no 1099-DIV will be issued but you are still required to report that income to the IRS.

Understanding your Form 1099-B

What is a Form 1099-B?

If you're a US person and you've sold shares in the tax year ended December 31 2025, this is the form we'll provide to you.

We are required to provide a Form 1099-B to both you and the IRS to comply with our reporting obligations.

What information is reported on the Form 1099-B?

The Form 1099-B will show the following information:

- Name of recipient

- Address

- Taxpayer identification number (TIN) of the recipient

- Details of the shares sold on plan participants' instructions or on participants' behalf, including sales of equity plan shares to cover tax

- CUSIP or other applicable identifying number

- The cost basis for covered shares (if covered)

- Whether any gain or loss is long-term, short-term or ordinary (if covered)

- The gross proceeds of the sale

- Federal income tax withheld (i.e. backup withholding)

- The acquisition and sale date and other information required by the form in the manner required by the form

Who receives a Form 1099-B?

You will receive a Form 1099-B if you are:

- A US person (citizen or resident alien) or if you have US indicia (e.g. address) and have not provided Computershare with a W-8BEN; and

- You sold shares or received reportable payments during the tax year and the amount was greater than $20; or

- You had any U.S. federal tax withheld on a sale or other reportable payment.

Box 1b – Why is Box 1b “Date acquired” blank

This box may be blank if Box 5 (non-covered security) is checked or if the securities sold were acquired on multiple dates

Box 1c - What is the date shown in Box 1c "date sold or disposed"?

This date is the trade date of the sale.

Box 1d - What foreign exchange rate has been used to calculate the amount of US$ proceeds?

In line with the IRS instructions, we will always report the proceeds in US currency. Where necessary we will convert any non-US currency amount. If you elected to receive the proceeds in USD we reflect the actual FX rate applied, in all other cases we apply an average mid-market FX rate as at the settlement date of the sale.

Box 1d - Are the proceeds shown after commissions have been deducted?

Yes, the amount shown is after commissions relating to the sale have been deducted.

Box 1e - Why isn’t an amount shown in Box 1e "cost or other basis"?

There will not be any cost basis shown in Box 1e if the shares sold are 'non-covered' shares (please refer to the glossary for information on 'covered' and 'non-covered' shares).

If the shares sold are 'non-covered shares' Box 5 of the Form 1099-B will be checked.

Computershare is not required to report the cost basis for sales of a non-covered share.

Box 4 - What does the amount in Box 4 "Federal income tax withheld" show?

This amount relates to any backup withholding Computershare has deducted from the sale proceeds. See below for FAQs on "backup withholding". No other taxes will be reported within Box 4.

Box 1g – What does the amount in Box 1g “Wash sale loss disallowed” show?

The amount shown in Box 1g is the loss resulting from wash sales occurring in respect of your equity plan shares. This portion of the loss is not allowable for that sale date and is added to the cost basis of the shares repurchased within 30 days of the sale.

What if I’ve had a wash sale?

If your loss is disallowed because of the wash sale rules, you can add the disallowed loss to the cost of the new plan shares. This adjustment postpones the loss deduction until the sale of the new plan shares or securities. Your holding period for the new plan shares or securities includes the holding period of the stock or securities sold. Wash sale adjustments should be reflected in column f (code W) and g (amount of adjustment as a positive number) on Form 8949.

What is a 1099-B supplemental?

This is an additional statement that we deliver to you to help you fill your Form 8949. It contains detailed information on the transactions reported on your Form 1099-B.

You will find this statement in EquatePlus in Library under Documents section.

NOTE: 1099-B supplemental is an optional statement which may not be issued for you depending on the agreement with your employer.

What information is reported on 1099-B supplemental?

The 1099-B supplemental will show the information reported on Form 1099-B, along with the following additional information, if known:

- Details of the shares sold on plan participants' instructions or on participants' behalf, including sales of equity plan shares to cover tax

- Plan type

- Date acquired (for non-covered shares)

- FMV at vest or purchase for non-covered shares

- Whether any capital gain or loss is long-term or short-term

- Ordinary income (amount of compensatory income) for ESPP plans

- FX rates used for conversion into USD

NOTE: 1099-B supplemental is an optional statement which may not be issued for you depending on the agreement with your employer.

Why is there no cost basis for non-covered shares on 1099-B supplemental?

The IRS only requires reporting of cost basis on the 1099-B for covered shares. We are not tax advisors and we may not have all required information to determine the cost basis for non-covered shares. On 1099-B supplemental we share the FMV value, and ordinary income, when applicable, as these can be used to determine cost basis for non-covered shares.

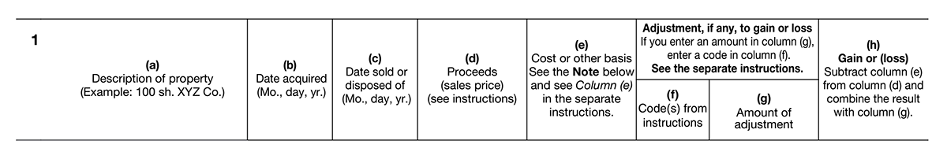

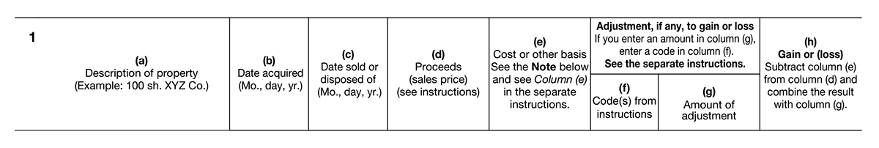

How information reported on 1099-B supplemental can be used to fill Form 8949?

Columns a) through e) on the Form 8949 correspond to Boxes 1a through 1e on Form 1099-B. Where Box 1b (acquisition date) and Box 1e (cost basis) are blank on the 1099-B for noncovered shares, the supplemental statement can be used to help complete this information. In addition, for covered shares, the ordinary income column on the supplemental statement can help you determine any adjustment to Box 1e 1099-B reported cost basis. Form 8949 is complex, and Computershare is not a tax advisor. Please consult a qualified tax advisor to determine the proper calculations and completion of Form 8949.

Backup Withholding

What is the backup withholding rate?

The backup withholding rate during 2025 is 24%.

What payments are subject to backup withholding?

The typical payments that will be subject to backup withholding are:

- Dividends reportable on Form 1099-DIV

- Gross proceeds from the sale of shares reportable on Form 1099-B

Will all payments to US plan participants be subject to backup withholding?

No, US participants will not be subject to backup withholding on payments they receive if they provide us with their correct TIN on a properly completed and timely received Form W-9 (unless they instruct on Form W-9 to have backup withholding applied).

How are participants notified of any backup withholding that has been deducted?

Dividends

The amount of backup withholding that has been deducted from dividends is detailed on the Dividend Confirmation statement which a participant receives after every dividend that is paid.

Gross proceedsThe backup withholding tax is detailed online and is also included on the trade confirmation/advice note provided one business day after the sale confirmation is received from the Broker.

The amount of backup withholding is also detailed on the Form(s) 1099 (Forms 1099-DIV and 1099-B) that we issue at the end of every tax year.

Cost Basis

Does the cost basis shown in Box 1e of Form 1099-B reflect any compensation income reported by my employer on Form W-2?

No, we are not required to increase the cost basis for any compensation income reported on Form W-2. However, the IRS Form 8949 (Sales and Other Dispositions of Capital Assets) gives you the opportunity to adjust the cost basis of the shares sold by the value of the reward reflected as ordinary income on Form W-2.

You should consult with your tax advisor to confirm how the information within the Form 1099-B and your transaction summary should be used to complete your Form 1040 (Individual Income Tax Return) including Form 8949.

Why do I have to report cost basis on my tax return?

US shareholders have always been required to report cost basis on their individual tax returns. However, because of the Emergency Economic Stabilization Act of 2008, plan administrators such as Computershare must now track and report cost basis for certain types of shares acquired after January 1, 2011 to both the participant and the IRS.

The total cost basis for any sale of shares originating from an employee equity plan is (amount of cash paid to acquire the shares + amount of ordinary (compensation) income recognized when acquiring the shares + any fees paid at acquisition). The Form 8949 allows you to make adjustments to the reported cost basis, typically the compensation income recognized when acquiring the shares.

What if I transfer or sell all of my shares; do I need to do anything?

If you sell all of your shares, the cost basis ordering method (e.g., FIFO, LIFO, etc.) becomes irrelevant. Cost basis ordering methods are only used when there is a partial sale, transfer or certificate issuance by the holder. When a holder sells or transfers their entire covered shares position, the basis for the entire position is provided to the receiving broker. Information on the acquisition of such shares will remain available for reference purposes in your EquatePlus account.

The Form 8949

What is a Form 8949?

If you are a US participant and sold shares in the tax year ended December 31 2025, you are required to report the information relating to the sale on Form 8949, "Sales and Other Dispositions of Capital Assets".

The Form 8949 allows both you and the IRS to reconcile amounts reported on Form 1099-B with the amounts you report on your income tax return. This may include adjustments to the cost basis shown on Form 1099-B to include any amounts reported to you as compensation income on Form W-2.

Information recorded on Form 8949 should be transferred to Form 1040, Schedule D, "Capital Gains and Losses".

What do I need to know when completing my Form 8949?

To properly complete your Form 8949, you may be required to adjust the cost basis of the securities sold, as detailed below. More information about the Form 8949 is at www.irs.gov/form8949. All amounts on Form 8949 are required to be stated in US dollars.

My Sell to Cover has been reported on both the 1099-B and W-2, will this result in the income being taxed twice?

No. Form 8949 is used to calculate the taxable capital gain (or loss). Form 8949 reflects any W-2 income, which will be recorded as an adjustment to the 1099-B cost basis on Form 8949 in order to avoid any double taxation. See below guidance on how to complete Form 8949.

Fill in your name and Social Security number at the top of Form 8949.

For Covered Shares

Fill in the grid (see example of grid at bottom of this page) in Part I (Short-term gain or loss), Checkbox A or Part II (Long-term gain or loss), Checkbox D, of the Form 8949 using information shown on your Form 1099-B. For covered shares, items (a)-(e) should be entered exactly as reported to you on Form 1099-B:

- the number and description of shares sold

- the date the shares were acquired

- the date the shares were sold

- the net sale proceeds ((shares sold * price)-fees paid)

- the cost basis reported on Form 1099-B

- the code to enter when cost basis is adjusted (typically, B, and if there is an amount of disallowed wash sale reported on Form 1099-B, then W as well)

- adjustment to cost basis – enter as negative number.

For nonqualified ESPP shares, this is the income reported to you at purchase on Form W-2 or 1099-NEC / 1099-MISC by the company.

For qualified ESPP shares, this is the income you recognized at sale due to a qualifying or disqualifying disposition. Typically the company will report this to you on Form W-2.

For option exercises, this should equal ((shares sold * fair market value per share (FMV) on exercise date) - (cost basis reported in (e) above, which is the exercise price)). FMV is the value per share used to calculate the compensation income the company reported to you on Form W-2 or 1099-NEC / 1099-MISC.

If a disallowed wash sale amount appears on Form 1099-B, this amount should generally be added as a positive number to the figure computed for this column (g) amount.

In addition, the adjustment includes variance between payment and reporting amounts due strictly to currency conversion rate differences with no monetary benefit.

- gain or loss (column (d) - column (e) + column (g)

If you have any further questions, please email taxreporting@computershare.co.uk. Alternatively, please visit the IRS website or contact a specialist tax or financial advisor.

For Non-Covered Shares

Fill in the grid (see example of grid at bottom of this page) in Part I (Short-term gain or loss), Checkbox B or Part II (Long-term gain or loss), Checkbox E, of the Form 8949 using information shown on your Form 1099-B. For non-covered shares, items (a), (c), and (d) should be entered exactly as reported to you on Form 1099-B. Item (b) should be on your supplemental statement. For non-covered shares such as restricted stock, restricted stock units, or SSAR exercises, Item (e) should generally be the FMV reported on the supplemental statement, times the number of shares sold:

- the number and description of shares sold (from Form 1099-B)

- the date the shares were acquired

- the date the shares were sold (from Form 1099-B)

- the net sale proceeds ((shares sold * price)-fees paid) (from Form 1099-B)

- the cost basis. For non-covered shares such as restricted stock, restricted stock units, or SSAR exercises, Item (e) should generally be the FMV reported on the supplemental statement, times the number of shares sold

- Leave blank

- Leave blank

- gain or loss (column (d) - column (e)

If you have any further questions, please email taxreporting@computershare.co.uk. Alternatively, please visit the IRS website or contact a tax specialist or financial advisor.