Maintain momentumThe past quarter has marked a period of dynamic but steady growth, as well as a refreshing, renewed confidence across capital markets more recently – and Computershare has been proud to stand at the heart of it. The IPO market is showing encouraging signs of recovery, with global exchanges welcoming a new wave of ambitious issuers. Our registrar and governance teams have been deeply embedded in many of these journeys, supporting clients from pre-listing structuring through to post-IPO lifecycle management. Notably, we were proud to support the successful listings of Valterra Platinum Limited and Greatland Resources Limited in June, followed by Metlen Energy & Metals plc in August – each representing a unique milestone in their respective sectors and a testament to the resilience of the UK capital markets. As a client-led, governance-first registrar, we’ve continued to deliver innovative solutions that meet the evolving needs of both listed and private companies. From complex corporate actions to seamless shareholder communications, our expertise has helped advisors and issuers navigate regulatory landscapes with confidence. |

New product launch: Computershare's UK Process Agent serviceNeed a legal UK address for a cross-border client? Computershare’s new Process Agent service acts as your UK-based representative to receive legal documents, notices, and court proceedings – essential for overseas entities entering agreements under English law. Why it matters Without a UK presence, a client can risk missed legal deadlines, costly disputes, financial penalties and reputational damage. Who needs it?

Computershare combines trusted expertise with speed and certainty. Our governance-first approach is relied upon by global clients, and our same-day setup ensures your appointments are handled swiftly and professionally. With transparent pricing and a secure digital platform, we make the process simple, reliable, and fully managed from start to finish.Get in touch today to learn how our Process Agent service can support your next transaction. |

AIM turns 30In the latest issue of Governance + Compliance magazine, Jacob Pitt, Manager in Computershare’s Entity Solutions team examines the implications of the reforms outlined in the market's recent discussion paper on the future of AIM. Read the article: AIM low and Miss?. |

The UK’s paperless future: Digitisation Taskforce final reportThe Digitisation Taskforce’s final report is a blueprint for transforming how UK share ownership structures are recorded and capital markets operate – and our experts at Computershare have fed into this review. With the government’s full backing, the UK is seeking to become a global leader in digital finance infrastructure. After many years, we are excited for these proposals to end the issuance and use of physical share certificates for traded companies – a major step toward modernising the UK’s capital markets. After many years, we are excited for these proposals to end the issuance and use of physical share certificates for traded companies – a major step toward modernising the UK’s capital markets. Read more in our blog. |

Meet Investor Intelligence – Computershare's new bondholder intelligence teamSince joining the Computershare family in January 2025, CMi2i has become the cornerstone of our Investor Intelligence capability within the newly established Investor Engagement business. This new division brings together CMi2i, Georgeson Advisory, and the ingage platform, offering a fully integrated approach that helps companies engage with and influence investors with clarity, speed, and precision. Founded to deliver best-in-class investor intelligence to issuers and their advisors, CMi2i is trusted by many of the world’s largest companies for capital markets insight, IR support, and investor engagement. Over the past 18 months, the team has identified holders of more than 600 bonds across ratings categories and currencies. With confidentiality at the core of our work, we have supported some of the market’s most significant debt transactions – all without a single leak. Investor Intelligence can support your clients in better understanding their bondholder base for:

To learn more about CMi2i, a Computershare company, and their debt offering please visit here. |

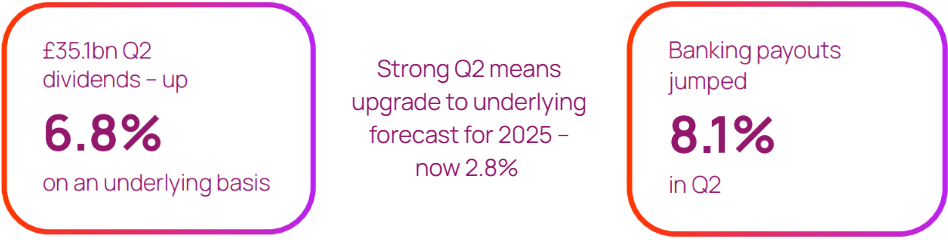

Dividend Monitor | UK dividends fell 1.4% in Q2UK companies distributed dividends of £35.1bn in Q2 2025, falling 1.4% on a headline basis year-on-year owing mainly to one-off special dividends halving to £2.0bn and the effect of the dollar’s weakness. However, the underlying picture (which strips out one-offs and the effect of exchange rate movements) was significantly better – as regular dividends of £33.1bn were 6.8% higher on a constant-currency basis, beating our forecast by £230m. For a detailed analysis, please read the Q2 2025 UK Dividend Monitor.  |

Georgeson ranked #1 in Bloomberg's Global Activism League Tables for H1 2025Activism campaigns continue to be highly present, so we are delighted to be ranked the #1 proxy solicitor and activism advisor globally for H1 2025. Read the report here.Head of Georgeson Cas Sydorowitz shared a special video announcement. |

Upcoming eventsTo learn more about the upcoming conferences and events we are laying on or attending, follow here.Including:

|

Supporting the LSE’s City Insights DayOn Tuesday 22 July 2025, Computershare had the privilege of taking part in a unique event at the LSE – aimed at students aged 16–21 who are curious about careers in financial services and the City. Recognising that not everyone secures internships or graduate schemes, Neil Shah of the LSE wanted to offer something meaningful – an in-person opportunity to explore the industry up close. On the day, 100 brilliant students/budding entrepreneurs met professionals across banking, sales, law, accountancy, PR, and research – all with the aim of demystifying the City, asking questions, and building connections. Computershare was proud to be part of such an auspicious day.

|

Contact us to learn more about how we can help your clients IPO Intelligently.

Cecilia Williams

Client Solutions Director > Computershare Investor Services

Cecilia has over 25 years' experience in the financial services sector and leads Computershare’s Issuer Services new business activity in the UK. She has provided senior oversight to over 100 IPOs in the last 5 years in London and international markets. These deals include: ARM, Fadel Partners, WAG Payments, Polestar, Helios Towers and Aurrigo International. T: +44 (0)778 643 0580 Cecilia.Williams@computershare.co.uk

Andrew Lyons

Client Solutions Associate Director > Computershare Investor Services

Andrew has over 15 years’ experience in corporate communications. His considerable relationship management and business development experience within the Financial Services sector is helping Computershare build strong, enduring and productive relationships with clients and advisers at every part of the IPO journey. T: +44 (0)797 705 4648 Andrew.Lyons@computershare.co.uk

Chris Guy

Business Development Manager > Computershare Investor Services

Chris offers our clients over 30 years’ experience in the share registry industry, and specialises in IPO transactions on the AIM and main market of the London Stock Exchange for both UK and overseas incorporated companies. Chris works with our clients and their advisors in the vital early planning stages and appoints our client team to ensure a smooth execution and delivery. T: +44 (0)771 185 6479 Chris.Guy@computershare.co.uk

Sam Vernazza

Client Solutions Manager, Issuer Services

+44 (0)748 332 1078 sam.vernazza@computershare.co.uk

View all archived IPO Advisor Bulletins

IPO resources and insights for advisors