The decision to offer an ESPP is a lot like buying a car. Not only must you consider the upfront costs, you should also consider what features you want, what it will take to maintain, and generally keep it running into the future. Like a vehicle, ESPP’s have outright and annual costs, but it’s not always immediately clear what those are and compensation expenses are only part of those costs.

Determining what it will cost to own and operate your own ESPP can be a little tricky, but it may not be as much as you think—and the tax benefits may just offset much of that cost. To calculate an ESPP’s total cost, you should include expenses such as administration and share and governance costs, which contribute to—and increase the overall cost of the plan.

Meet the true cost of an ESPP:

Compensation Costs

The compensation costs to operating an ESPP directly correspond to the way in which the plan is designed. Four key plan design considerations significantly drive compensation expenses. These are plan type, lookback feature, discount and length of purchase period. Each is described further below.

Plan Type

The type of plan you choose to offer will impact overall program costs. A qualified plan gives participants the opportunity to purchase company stock at a discount and delay the recognition of tax on the discount until the shares are sold (employees are in charge of when the taxable event occurs), but requires compliance with certain inflexible rules and regulations and comes with many administrative nuances. Where the participant fails to meet certain holding period requirements for preferential tax treatment, the company is entitled to a corresponding wage deduction. A non-qualified plan is an alternative way in which employees can purchase company stock with fewer regulatory requirements and easier administration, but without the tax advantages available under a qualified plan.

Lookback Feature

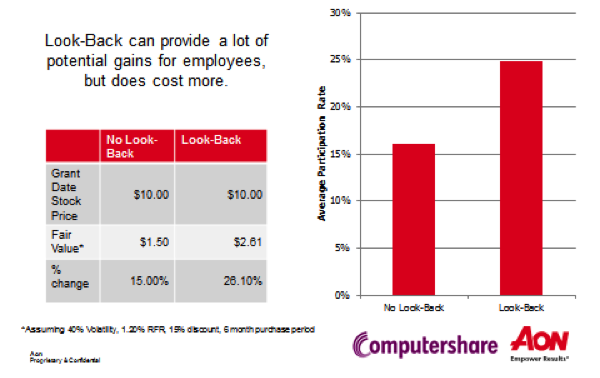

A lookback feature can provide a lot of potential value to participants, but can significantly increase compensation costs and is a difficult concept to communicate to participants. Plans with a lookback feature, particularly those that have longer offering periods, e.g., 12 to 24 months in length, are expensive. In the diagram below, you’ll see that there is a large increase in the fair value of a plan with a lookback feature; however, the average participation rate in a plan without a lookback is also a lot less. If you are exploring ways to save money on a plan, the lookback feature should be a key area of focus given its high price tag.

Discount

The discount is the largest driver of plan participation and the easiest design feature to communicate. Generally, the greater the discount, the greater the participation in the plan; however, higher plan participation also means higher plan costs. That said, plan participation is also a strong indicator of how much value employees are getting out of the plan—because employees are buying company stock with their money, the more employees who participate, the more who believe and understand it.

Plans that offer a 5% discount or less and no lookback are considered non-compensatory and have no financial impact to the company. As such, a non-compensatory plan can be a more cost effective way to offer an ESPP and still provide a benefit.

Length of Purchase Period

The longer the purchase period, the higher the compensation expense, particularly where the plan includes a lookback feature. A further consideration with regard to the length of the purchase period should be the amount of time participants are illiquid. In other words, how much time exists until participants can cash out and receive their shares / what are the liquidity constraints? Purchase periods longer than six months are known to be problematic to this end.

Administration Costs

In addition to compensation costs, there are other expenses—direct and indirect, associated with the plan, like the administration of it. The costs of the general topics outlined below (such as educating employees about the program, processing enrollment under the plan, providing customer service / support to answer questions about the program to where employees are located) fall under this heading.

Plan Design

Generally, the more complex the plan, the higher the administration costs will be.

An open market purchase plan is largely easy to operate as there are no real administration costs and these plans rarely offer a lookback feature or discount. They are simply a convenient, lower cost way (no commissions involved) for employees to purchase shares of company stock on a regular basis and can be managed in house or leveraged through a transfer agent relationship.

A non-qualified plan is not bound by any formal tax regulations or share limitations. Plan design can be more creative and sometimes more complex than conventional open market plans. This flexibility in plan design gives companies a lot of freedom to construct a plan that best suits their needs and as such, these plans can be very valuable to participants while allowing the company to manage and control the overall administrative costs.

Qualified plans are perhaps the most common type of ESPP, but are also the most expensive in terms of administration costs. These types of plans must be operated in accordance with certain IRS rules and regulations, which include disposition tracking, tax reporting and more, ultimately raising the complexity level and administration costs of the plan.

Invariably, plan design also affects plan participation. With greater participation comes greater overall costs; however, greater participation also means increased plan effectiveness because more people are buying into the program. Therefore, a good rule of thumb is to always balance plan design decisions with participation objectives.

Where Are Your Employees Located?

While not always an obvious issue, where employees are located plays an important role in terms of the administration costs. For example, programs with only U.S. participants generally mean less complicated plan management. Administrative updates, file changes, payroll contributions, and other such issues related to the management of a U.S. only plan should be relatively simple and cost effective. Conversely, programs with participants around the world are typically much more complicated to administer and cost a lot more to operate. From managing multiple global payrolls and foreign currencies to ongoing due diligence, engagement of local expertise to assist with ongoing plan maintenance and compliance with regulations, operating a global program can be exponentially more expensive.

Where Does Administration Happen?

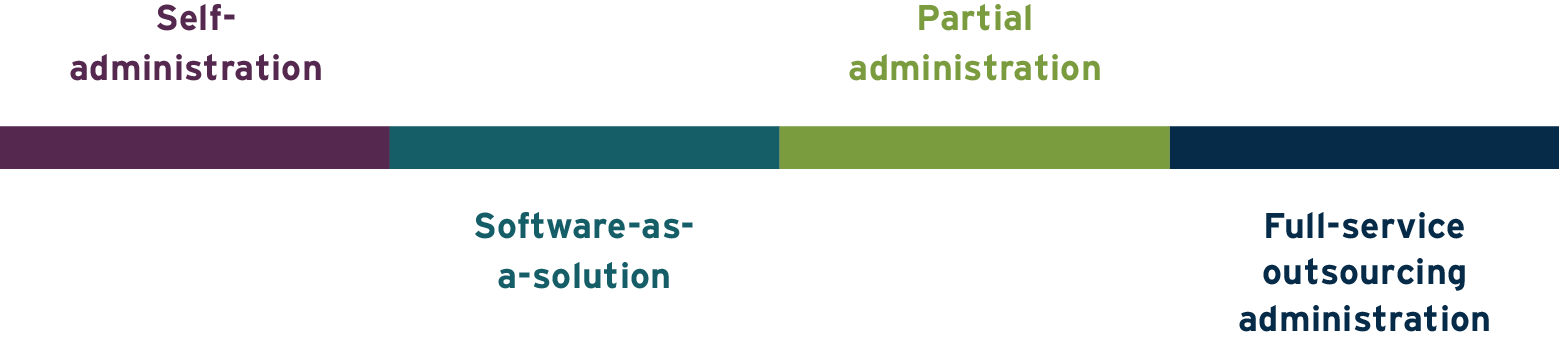

Once you finally design a plan, someone has to administer it and perform the day-to-day tasks. Some companies choose to handle the ESPP administration functions internally and others outsource them. The cost can range from minimal if using pre-existing in-house software to buying an off-the-shelf application to use in-house to partnering with an outside vendor to facilitate a large majority of the administration. Whether you decide to administer your program internally or use a fully outsourced service provider, there are costs to setting up the infrastructure to support the plan, e.g., the payroll department needs to have certain functionality to manage payroll deductions, and the HR/benefits department will need to incorporate plan eligibility into the HR record keeping system. The use of technology in ESPP administration will almost certainly contain administrative costs. With the right technology platform, employees can use online services to learn about the plan, elect to enroll and get help with the program. Deploying technology that allows for employee self-service will dramatically reduce the cost of enrolling an employee in benefits and could alleviate costs in hiring additional staff to manage the plan.

Due Diligence/Program Compliance

Don’t underestimate the true costs of program compliance, such as consulting for overall plan design and prospectus development; securities filings and other regulatory requirements; translations where required and appropriate. These activities / actions consume valuable employee hours every year. Initial and ongoing compliance can be expensive and is an area where many companies deeply underestimate the true costs.

Communications

Most companies don’t properly budget each year for ESPP plan communications. Costs associated with posters, postcards, emails and educational materials are simply not planned and budgeted, despite the fact that it is widely known that a successful communication campaign can increase the effectiveness of the ESPP.

Further, since most companies operate their plans on a very tight budget, when planning annual costs, they generally only budget for administration fees; they don’t always take into account pass-through charges, such as printing and mailing costs of statements or any other non-scheduled events that may require communicating to the broad-based ESPP population. With a large number of eligible participants, a communication can quickly become cost-prohibitive and companies sometimes choose not to send anything, which can affect the success of the ESPP.

Share and Governance Costs

One final area that hasn’t yet been factored into the ESPP cost equation: corporate governance considerations.

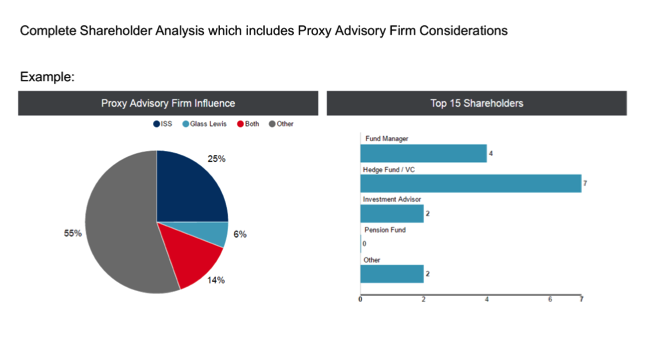

Proxy advisory firms, like ISS (Institutional Shareholder Services) and Glass Lewis, generally support ESPP programs with very few exceptions. Formulating an ESPP proposal and/or developing an effective strategy for obtaining shareholder approval of an ESPP proposal is a relatively straightforward exercise and can generally be done without any excessive legal or registration costs.

As illustrated in the diagram below, a best practice recommendation is to complete an analysis of your top 15 shareholders anytime you are looking to put a plan vote to shareholders, including your ESPP. This will ensure that you understand how your shareholders are voting and which proxy advisory firms they follow when the plan is up for vote, and avoid any surprises.

Conclusion

An ESPP is an incredibly useful tool to recruit and retain staff, and I think we can all agree that most employers would prefer to offer their employees the best possible selection of benefits under their plan. However, few companies are so profitable and indifferent to expenses that they can afford to disregard costs. Therefore, understanding the true costs of the ESPP upfront will allow you to design and plan an ESPP that can be the most effective and successful, and at your price point.