You're using 15/30 hours of free childcare

If you're in England and currently making use of the 15/30 hours of free childcare, or are about to apply, don't forget you can use your childcare vouchers to pay for any additional childminder or nursery costs over-and-above your free entitlement.

Check out our blogs, "How to apply for 15/30 hours free childcare" and "30 hours free childcare – reconfirming your eligibility" for more information.

You're on maternity and paternity leave

› If you’re on an enhanced maternity/paternity leave package, there may be sufficient funds to continue paying for the childcare vouchers from your salary.

› If you’re on Statutory Maternity Pay (SMP), many employers will pay for your childcare vouchers - you’re not allowed to salary sacrifice your SMP for a childcare voucher. But some employers’ scheme rules may ask you to stop your order.

› If your employer requires you to stop your vouchers, you may become ineligible for childcare vouchers if more than 12 months pass between your last order and when you return to work. Ask your employer if you can receive a childcare voucher as part of a paid ‘Keep in touch’ day, even if it’s the minimum £20 or use a day's annual leave.

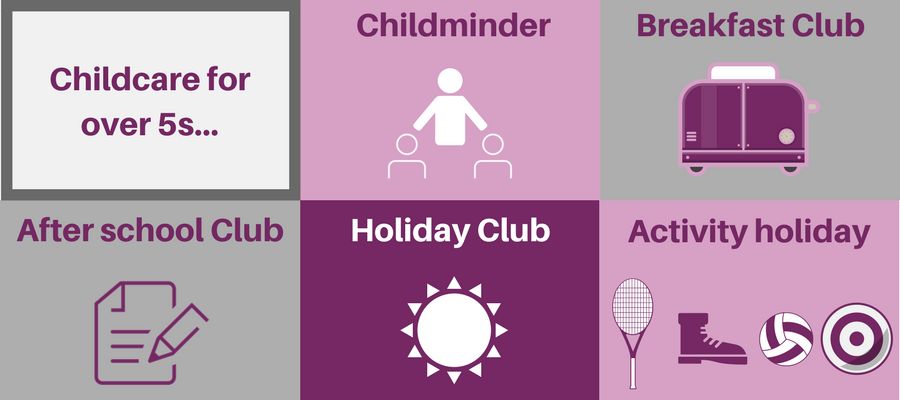

You need childcare for school-aged children

Once your

child starts school, you can use your childcare vouchers in a variety of settings, such as breakfast clubs during term time and holiday clubs

in the school holidays. You can use them until 1 September

following your child’s 15th birthday (16th birthday if registered disabled).

Your carer is not registered

You've built up an account balance