Every year, Computershare analyzes and interprets data drawn from the hundreds of annual and special meetings we scrutineer to provide statistics, insights and observations on trends affecting our industry.

Attendance Trends

With the emergence of virtual meetings in Canada this year, we are curious to observe how meeting attendance will be impacted and will be tracking these results.

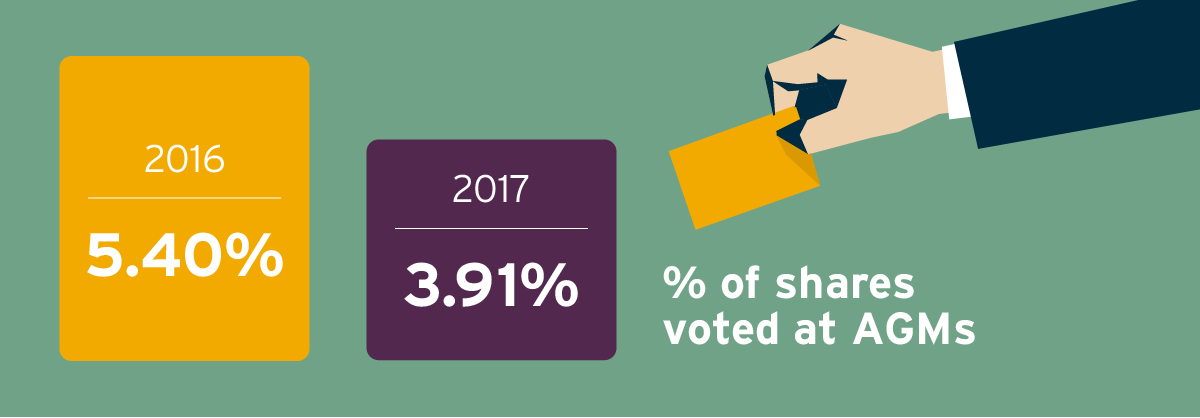

Voting Trends

Of the share capital voted at AGMs in 2017, 3.9% was voted by individuals appearing in person, down a point and a half from the year before. This figure speaks to continued low attendance at meetings, with a downward trend in meeting attendance over time. The majority of shares voted are appointed to management, making it highly unlikely that votes cast by individuals present at meetings could sway the outcome of any resolution.

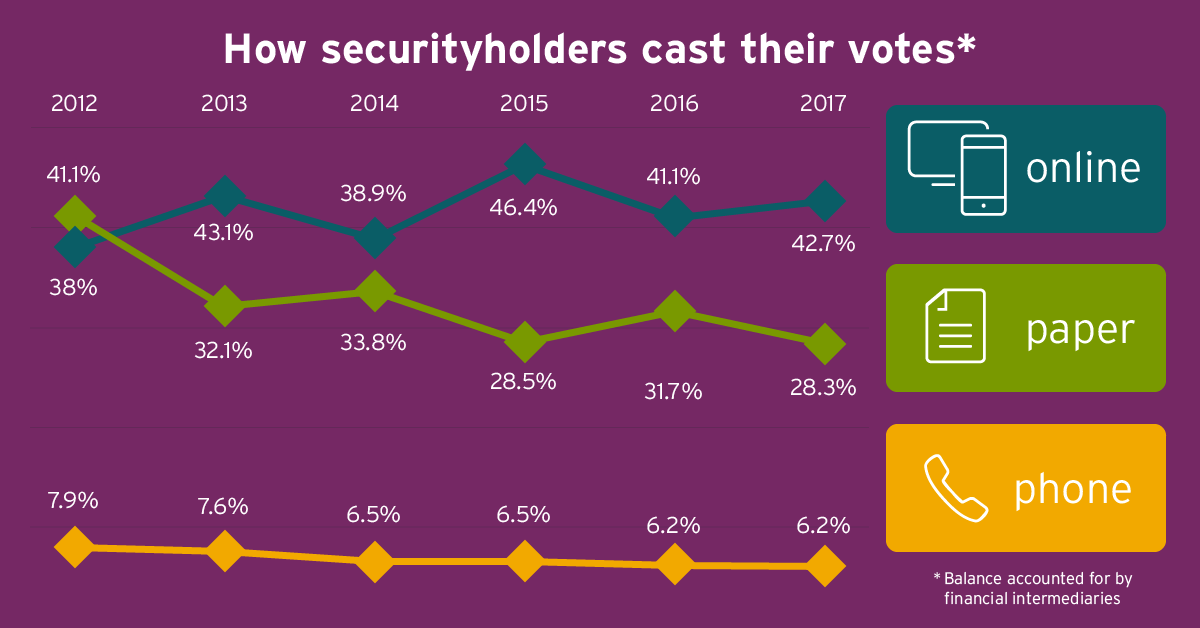

In recent years, we observed an overall upward trend in the number of votes cast electronically, as securityholders become more comfortable with using electronic devices for voting.

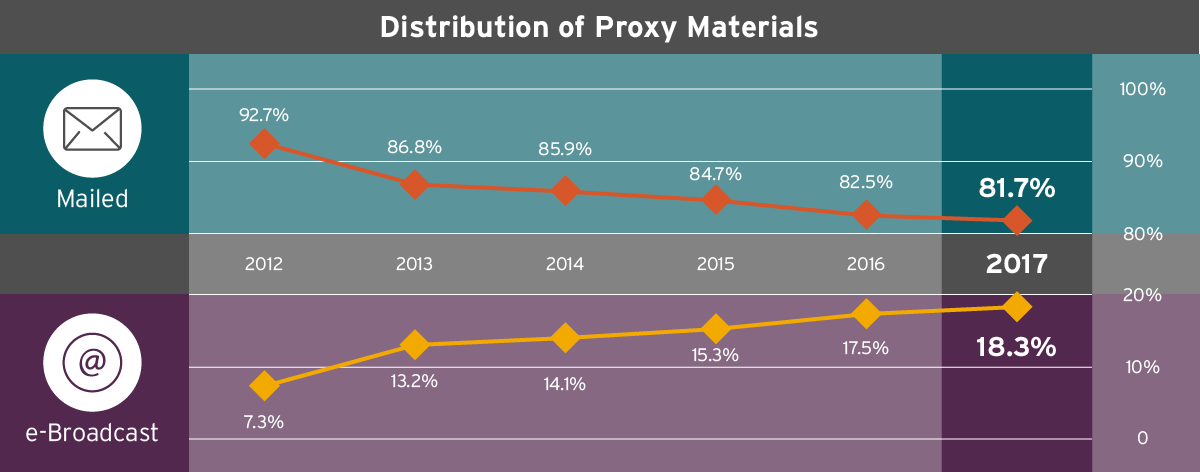

Distribution of Proxy Materials

We continue to observe a moderate but steady increase in the popularity of e-Broadcast of proxy materials. At 18.3%, e-Broadcast is at the highest in the past six years. For issuers that are considering e-Broadcast of proxy materials, or looking to increase the number of securityholders you communicate with electronically, we suggest leveraging your dividend mailings, statements, and Investor Centre messages to solicit consent.

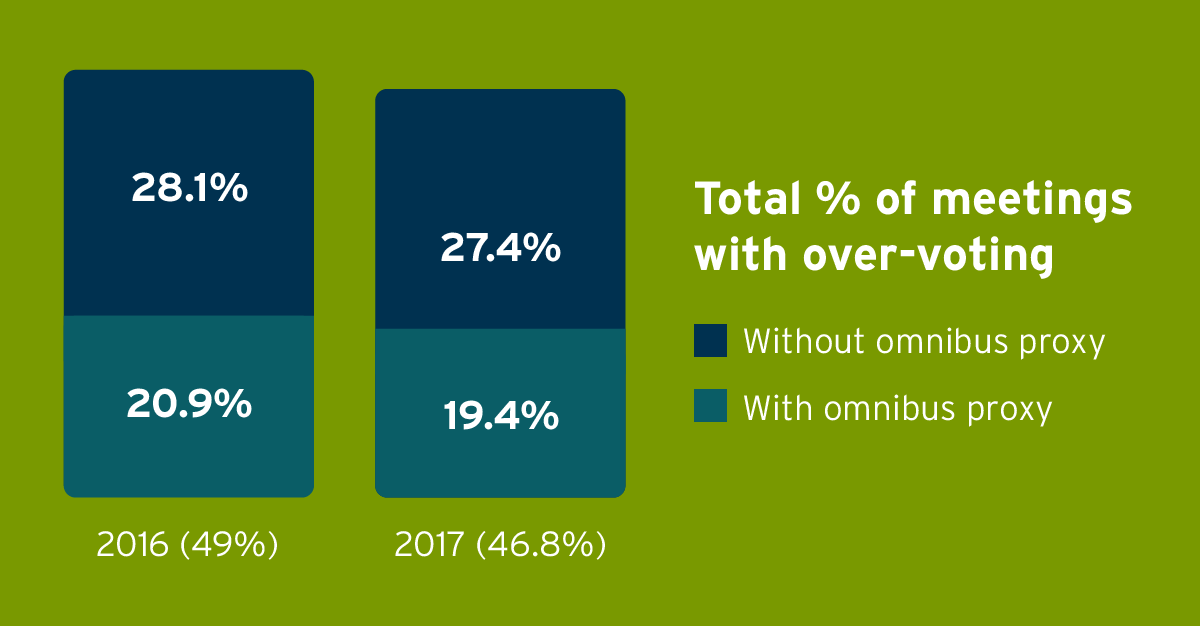

Over-voting

42% of meetings administered by Computershare during the 2017 proxy season had some occurrence of over-voting, down slightly from 49% in the previous year. Over-voting remains a persistent problem in Canada.

Over-voting occurs when the tabulator receives more votes cast than can be allocated against an intermediary position. It raises concerns for retail and institutional securityholders who want assurance that their entire vote was counted.

For issuers, over-voting causes uncertainty about whether or not the proxy count is truly reflecting the intentions of their securityholders, and therefore if proper approvals have been received for the election of their board of directors and corporate initiatives.

Notice and Access

The number of Computershare clients using Notice and Access declined for the first time since the solution was introduced in 2012. Last year we reported that Notice and Access may be nearing its peak. We do not expect to see much more adoption of the solution until legislative changes permit Notice and Access use by CBCA issuers.

CBCA issuers can currently receive an exemption that relieves them from the requirement to mail the Information Circular to registered holders. However, mailings of the Annual Financial Statements and material to beneficial securityholders are not covered. Bill C-25, proposed by the Government of Canada in 2016, will allow CBCA issuers to use Notice and Access.

As the leading provider of meeting services and securityholder communications in Canada, Computershare offers a variety of solutions to help make your meeting a success. For more information on Computershare’s Meeting Services, please contact your Relationship Manager or a member of our Sales Team.